- Debt-to-earnings ratio out-of 41% or reduced

- Proof of earnings and you can/otherwise a career

Borrower certification and you can eligibility standards

S. Service of Pros Issues in order to be eligible for people Va loan. You can even qualify for an excellent Va financing if you see you to definitely or maybe more of one’s adopting the criteria:

- Your offered throughout the You.S. military for around 3 months during the wartime or at least 181 consecutive days throughout peacetime (effective responsibility).

- You served at the least six age throughout the reserves otherwise National Shield, otherwise offered 90 days (no less than 29 of those consecutively) around Term 32 requests.

- Youre a wife of an experienced which died regarding line of responsibility or off an army provider-linked handicap.

Likewise, Virtual assistant financing can only be used to have house one to individuals desire in order to entertain because their first residence in this 60 days away from closing the mortgage. Borrowers thinking of buying otherwise refinance an additional domestic otherwise resource assets would have to sign up for a low-Virtual assistant financing.

Loan-to-worthy of limitations and you will calculations

New LTV is the newest loan amount split because of the residence’s appraised well worth. Back to the earlier example, for those who have $200,000 left in your financial together with family appraises for $400,000, their LTV proportion was fifty%.

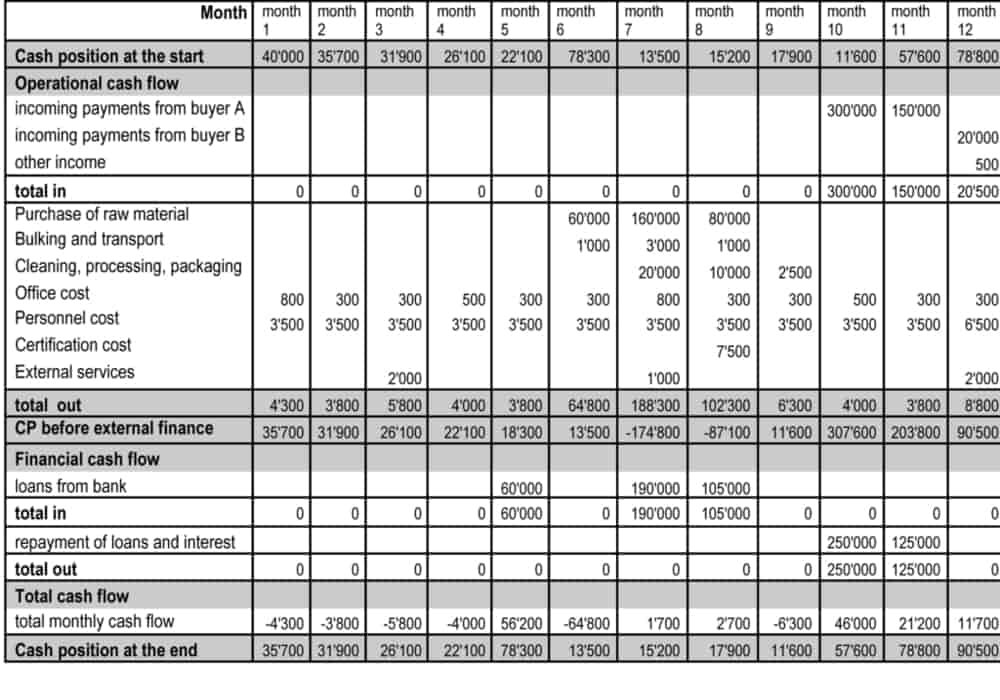

While some lenders accommodate LTV percentages as much as 100% for the money-away re-finance finance, other lenders limitation this to ninety%. The following dining table reveals a good example of how Va cash-away refinance mortgage limits have decided.

This might be a fairly simplistic computation once the financing processes also pertains to lender charge, the new Virtual assistant money fee and you will closing costs you to ount of money supplied by their re-finance.

Benefits associated with a beneficial Virtual assistant cash-away re-finance

Not in the advantages regarding Va money – such as for instance no money off, competitive interest levels etc – there are a number of advantages to Va dollars-away re-finance money. Next section info those individuals positives.

Accessibility home equity

If you are normal bucks-away re-finance finance cover the level of security you might pull from your home, one of several excellent site to observe determining features of a beneficial Va cash-out re-finance ‚s the ability to access to 100% of one’s house’s security. For the majority individuals, this is the biggest way to obtain financing offered to all of them. Virtual assistant bucks-away refinances also are much less limiting than many other types of home security financing.

Debt consolidation and you can monetary autonomy

The added exchangeability away from an effective Va bucks-aside refinance makes it an attractive choice if you’re looking to consolidate financial obligation. By eliminating numerous costs, Virtual assistant cash-out refinances can take back much-required loans that assist your plan out finances on the you to definitely in check payment with comparably lowest-rates of interest.

Money home improvements or fixes

Va bucks-aside refinances are an ideal choice if you want to protection costly family solutions or home improvement tactics. Whether you ought to change your rooftop, revision new Cooling and heating system otherwise add a patio towards lawn, Virtual assistant cash-aside re-finance financing can provide the mandatory funds in place of your having to take out an expensive, high-focus mortgage.

Capital opportunities

Another distinguished advantage of Virtual assistant dollars-aside refinances ‚s the possibility to utilize the the newest capital getting some financial investments eg holds, brand new people if not a new possessions. With respect to the money, this can be perhaps the most high-risk use of the dollars-away fund you could choose. Therefore, it is important to check out the threats and you may advantages of every money ahead of committing funds from good Virtual assistant cash-out re-finance so you’re able to they.

Va dollars-out refinance compared to. Va mortgage

Va cash-out refinances was not the same as Virtual assistant money. When you are good Virtual assistant loan is employed for purchasing a home, Virtual assistant bucks-away refinances are acclimatized to availability new equity of one’s most recent assets. Occasionally, consumers additionally use Va dollars-out refinances to in addition tap into their property guarantee if you find yourself refinancing from a non-Virtual assistant to a good Va mortgage.For more information, listed here are four suggestions for having the better Virtual assistant loan price.