However they base the mortgage into the property value a house shortly after advancements, in the place of ahead of

These types of FHA-insured money will let you at exactly the same time refinance the first financial and you may blend it to the improvement will set you back for the a different sort of mortgage. Because your home is value significantly more, your own security and the amount you might acquire is one another higher. And you will get a company otherwise perform some work yourself.

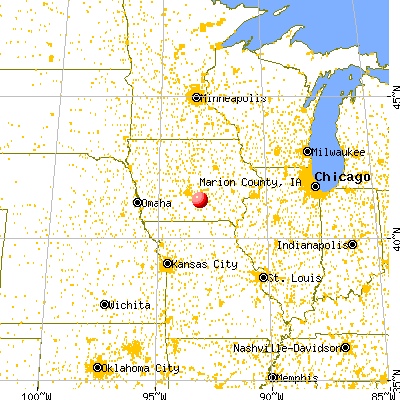

The new disadvantage is that financing limitations are very different by the county and are likely to-be seemingly lower. Plain old label try thirty years.

Energy-efficient mortgages (EEMs). Suppose the home’s R-worthy of is the jealousy of one’s cut-off. An enthusiastic EEM of Fannie mae or else you will definitely improve your obligations-to-income ratio because of the around 2 %. Utility bills was lower in energy-efficient home, so the resident can afford more substantial loan. EEMs have been used for new build; loan providers are actually moving him or her for present belongings. A keen EEM demands a determination your family match Fannie Mae’s stringent opportunity-performance requirements.

B and you will C money. Can you imagine you’ve got less than A cards or try not to complement plain old a position or money mildew? B and you will C funds is actually a great fallback. While many financial institutions give him or her, therefore would borrowing from the bank unions, brokerage home, and you can boat loan companies. You will also look for loan providers that push B and you may C financing for debt consolidation reduction which have enticing basic costs. Beware, though: Total desire and charges is high by lenders’ extra risk. And since B and you will C finance run out of uniform criteria and you will terms and conditions, contrasting them is hard.

When shopping for an agent, check with anybody you know, and look people recommendations you get

Taking individual. Homes aren’t the only financing collateral. Czytaj dalej „However they base the mortgage into the property value a house shortly after advancements, in the place of ahead of”