There’s something you need to only do inside the an urgent situation: mouth-to-throat resuscitation, the brand new Heimlich steer and cashing away a great 401(k).

Ok, atic. But, very early withdrawals from the later years can also be its wreck your bank account. That is because cashing away a 401(k) isn’t only costly, but it addittionally affects your capability to help you retire.

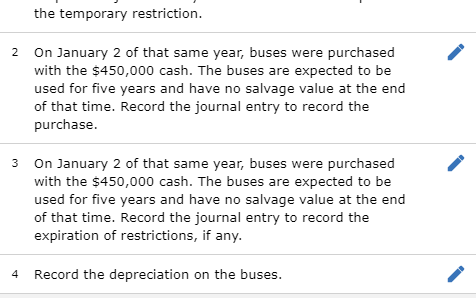

And additionally missing out into old age deals and possibly slowing down retirement, you will probably end up due currency for the Irs and you can using a beneficial ten% early distribution income tax. But not, brand new punishment are quicker severe if you utilize the money for a professional crisis.

Five reasons for cashing your 401(k)

Getting currency from your own 401(k) is actually a last hotel since the there is no means of avoiding using federal (and frequently county) taxes with the matter your withdraw.

However you might stop the second rates-new IRS’s ten% early delivery punishment-when you use the cash for example of those explanations:

Difficulty costs

When you yourself have what the Internal revenue service phone calls an instantaneous and you will heavier financial you prefer, there is certainly a chance you may not need to pay the ten% very early withdrawal fee. Qualifying www.availableloan.net/loans/2500-dollar-payday-loan/ reasons to have the percentage waived were:

- Health care

- Educational costs, room and you may panel

- Eviction or property foreclosure avoidance

- Funeral expenditures

- Restoring damage to your property

- Total and you will long lasting impairment

House get

That it withdrawal reasoning officially drops on difficulty category, but it’s really worth contacting aside. Czytaj dalej „Cashing Aside a great 401(k): What you need to Learn”