As to the reasons the latest Version?

The new adaptation within the appraisal charge shows the different levels of energy and you may options necessary to consider various how many payday loans can you have out in Ohio attributes. A larger or more book family demands additional time so you can appraise, while properties during the outlying parts you are going to suggest longer traveling times to own the fresh new appraiser, adding to higher fees.

4. Title Insurance rates and Queries

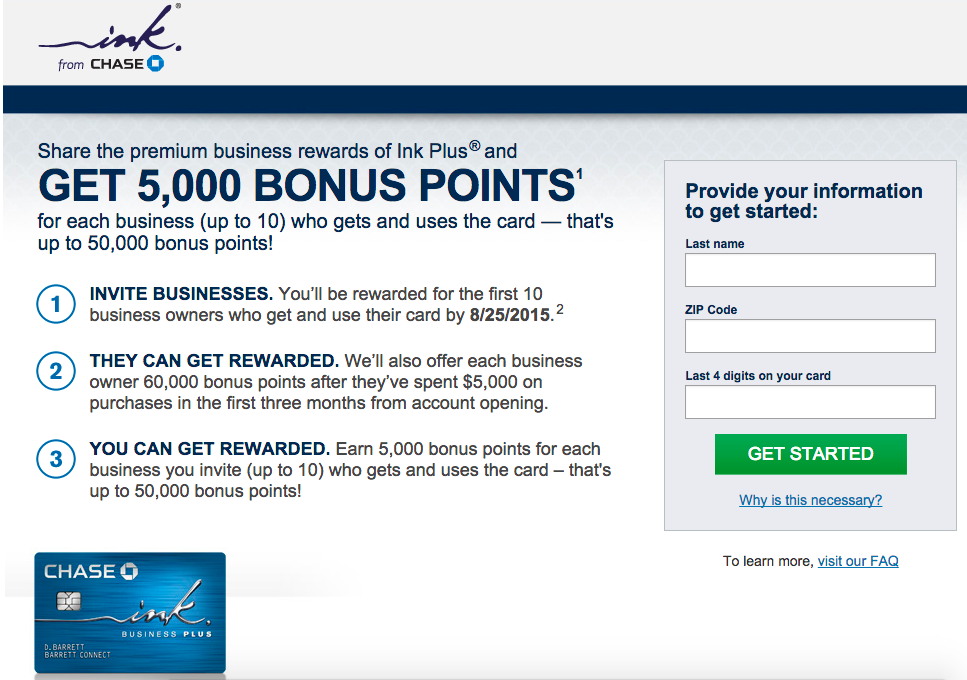

While inching closer to the last degree of purchasing a good family, a couple of terminology will often developed: Lender’s Rules Term Insurance rates and Term Browse (often called Examination Charges). Such are not only conformity but important steps in safeguarding forget the and you will making certain the fresh validity of your control.

What’s Lender’s Rules Term Insurance policies?

![]()

It discusses people court pressures you to concern the new lender’s legal rights to help you the house or property because of name facts receive after you’ve closed on the your property.

Just before giving a title rules, a name business usually conduct a comprehensive lookup out of public information to confirm this new seller’s straight to import control for your requirements. Czytaj dalej „These types of insurance is necessary and covers brand new lender’s hobbies regarding property up to their financial are reduced”