Sure. Getting an interest rate administrator should be stressful, specifically if you want to feel a leading earner, mainly due to this new variables which go into your decision-making.

When you find yourself mortgage underwriters think about the other levels of risk involved in the fresh new borrower’s borrowing character, home loan officers need be sure all the info and you will documents that borrower have filed. Besides do mortgage loan officials be sure what you registered try perfect, nonetheless they must ensure all the required appraisals and you will monitors was indeed complete.

These individuals points can merge to help make the employment off financial mortgage administrator some tiring. You are in addition to needed to end up being versatile, meaning you usually have so you’re able to rearrange their agenda to focus on certain documents and work deadlines.

Home mortgage manager paycheck: key requirements

To supply a far greater thought of the fresh new day to day life away from a mortgage loan manager, let’s look at the secret responsibilities. While you are you will find almost certainly other work one develop of for you personally to go out, the majority of your responsibilities given that an interest rate manager should include:

- Collecting suggestions. Meeting the possible homeowners’ monetary information, eg debt and you may fees, toward mortgage

- Delivering home loan alternatives. Presenting borrowers with assorted financial options which make experience having them economically

- Advertising. Determining future residents by advertising otherwise hosting seminars and other streams

- Maintaining the new books. Keeping detail by detail and you will accurate documentation of all of the your residence loan purchases

- Becoming wade-ranging from. Coordinating together with other financial world benefits, eg underwriters and you may household appraisers

- Adopting the regulationsplying which have confidentiality legislation and you can privacy procedures in the entire home loan software process

Is also mortgage loan officers build 6 figures?

This new salary away from a mortgage loan administrator is not clear cut. Depending on whether or not you get paid down into the top, on the back, otherwise some mixture of the two, you will likely are able to make six rates-but there’s nothing protected. To become a top earner-consistently-you’re going to have to have the best experience and work ethic. During the good many https://paydayloanalabama.com/north-courtland/ years, but not, even average home mortgage officials can make over $100,000 annually.

- Get information

- Community

- Embrace technology

- Have fun

1. Get tips

Just like the an interest rate manager, gathering suggestions (and you may ratings) must be a primary section of their income and you will business strategy. E-mail marketing, such as, is an excellent cure for collect tips. If you would like ensure that it it is easy, you can just ask your subscribers. While it is generally somewhat shameful to inquire of, fulfilled members is more than willing to give suggestions.

2. System

Network need not imply attending monster financial industry events or giving out countless providers cards in order to strangers. It may also indicate learning almost every other home mortgage officers, local gurus, domestic inspectors, and you may real estate agents. Simply by conference other world advantages, you can include a face towards the identity, providing your your own title towards a social profile.

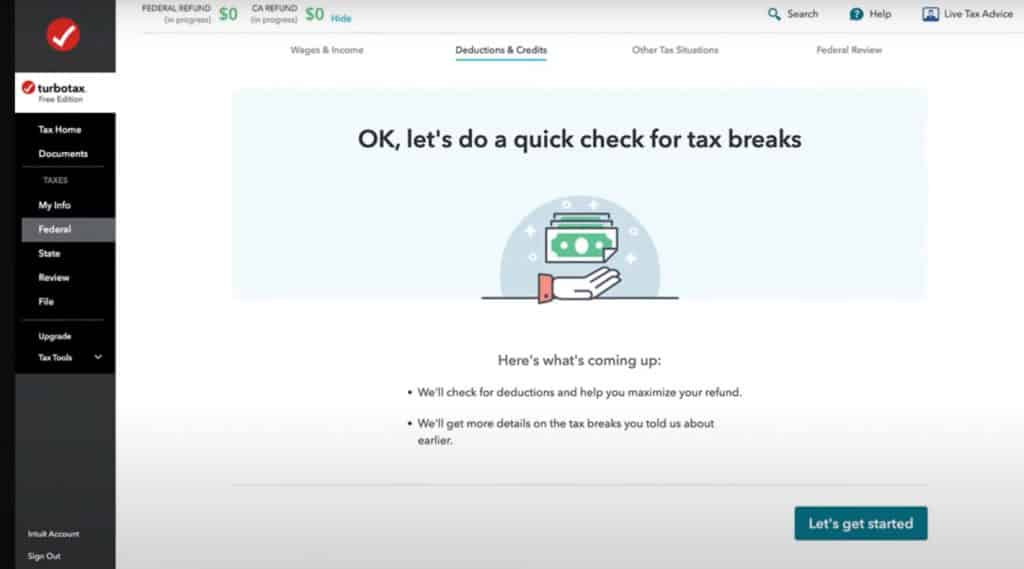

3. Accept technology

Sales automation software program is one to great way to accept technical within the the borrowed funds globe. Including, deals automation decrease time-taking works out of your everyday work. Certain application could even make articles for your social media and you will instantly post it to you personally. Someone else are capable of your own email address paigns, make feedback, and you can secure information.

4. Have some fun

Whilst it can sometimes be hard to do they, providing returning to yourself is one of the better an easy way to stop burnout. A beneficial 2017 studies learned that small enterprises are practically five times less likely to want to take time on their own than the mediocre American worker. Bringing time and energy to have fun-to possess fun-helps it be more likely on the best way to are nevertheless centered and you can help make your brand.