Similarly, an SBC loan are an investment property loan protected of the an excellent commercial house. Why don’t we see additional similarities and you will variations.

Private loan providers typically look mostly from the income to possess home-based and you can industrial mortgage loans. Whenever you are a good credit score is extremely crucial, the primary foundation has a financial obligation-Solution Publicity Proportion (DSCR) one to reveals new borrower’s ability to repay the loanmercial a home money just have alot more complexity than just home-based mortgage loans.

Such as for example, having commercial qualities, the fresh underwriter are looking at numerous apartments in the place of one to. It is very hard to assess the economic reputation commercial clients, very lenders will comment this new book history rather.

When working with old-fashioned loan providers as opposed to personal lenders , industrial a residential property money become way more nuanced. Banking companies wanted much high supplies and much much more paperwork.

One another form of functions wanted earliest mortgage records, including your own be certain that, book paperwork, and you may entity files. A professional loan will need subsequent papers, according to brand of property. Examples include occupant estoppels, non-interference agreements, or lockbox arrangements.

Visio Financing allows short-to-typical people to grow their portfolios from local rental attributes, in addition to accommodations. Our very own DSCR Financing are underwritten playing with possessions height cashflow, in lieu of private income. Our company is happy to provide:

Industrial Home mortgage Criteria

Prior to investigating industrial real estate funds, you should choose which kind of home you would like to pick, since this have a tendency to impression what type of mortgage you follow. To have funding services, good DSCR mortgage are a far greater choices than many other industrial lending possibilities, since it even offers a simple loan acceptance techniques, limited individual finance analysis, shorter strict financing conditions , and you will common sense lending stipulations.

Credit score

Very industrial lenders, plus Visio Credit, require a credit rating with a minimum of 680, but this will are very different with regards to the lender’s conditions and terms. Essentially, high credit ratings present most readily useful cost. The higher your rating, new closer the genuine interest rate is to try to the top rates that is afforded to the really really-qualified borrower.

One of the benefits regarding looking for an effective DSCR financing is the fact you will find quicker data to your credit rating just before credit approval, making it easier having care about-employed individuals than the conventional financial station. DSCR fund are also perfect for restricted partnerships just like the, instead of extremely finance, you could potentially acquire as the a business entity in the place of a single.

Deposit

For commercial home money, you want a loan-to-really worth ratio out-of 80% or down, which means that make an effort to render a deposit with a minimum of 20%. Visio Lending encourage a keen LTV as high as 80%.

Worth of and you may Amount borrowed

Usually, the minimum property value are $150,000. Regarding the loan matter, the littlest industrial mortgage you can fundamentally supply is actually $75,000. The most amount borrowed depends on brand new property’s kind of, estimated cashflow, the brand new LTV, or other requirements.

Ideas on how to Make an application for a commercial Mortgage

When you rely on Visio Credit getting a professional financing, you take advantage of a smooth procedure, aggressive rates, and you can sound judgment credit standards that let your increase your profile easily. Listed here is a quick report on what you could assume once you prefer us since your commercial real estate loan financial.

Because you start the process to own a commercial financing, take inventory of one’s finances, just like your credit history, bucks supplies, and you will month-to-month cashflow, to recognize exactly how much you really https://cashadvanceamerica.net/personal-loans-ok/ can afford.

Making use of all of our home loan calculator considering newest rates in addition to financing number you’re thinking about, you can see when you are heading about best recommendations inside the reference to payment per month systems. Make sure you reason behind settlement costs and advance payment when it comes to your own upfront can cost you. This will help you observe far you really can afford, which can only help you restrict your home choice.

Place Goals

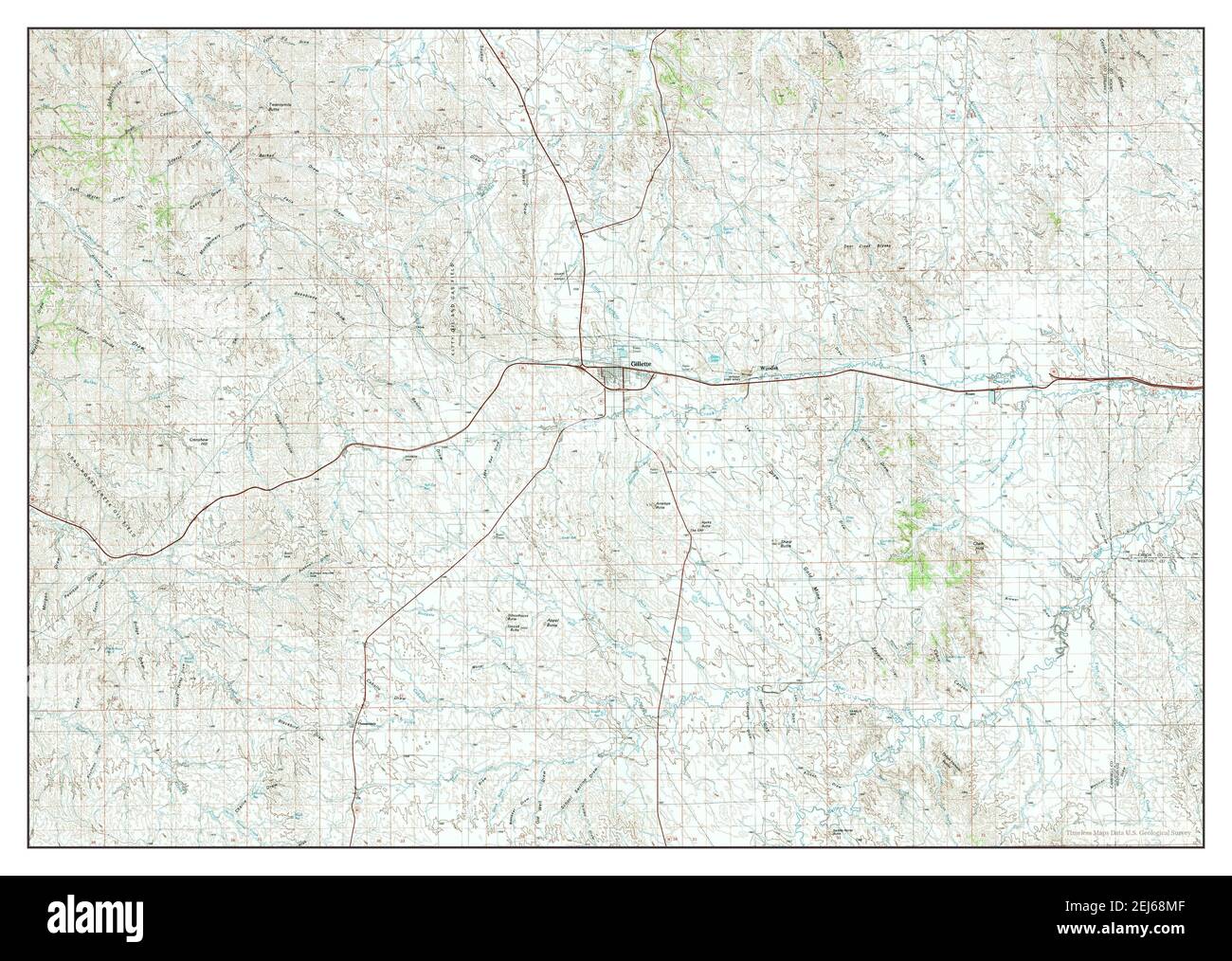

Now that you be aware of the loan amount you can access, it is the right time to feedback existing houses that may do the job. Work at a qualified industrial realtor to locate properties that suit your criteria according to dimensions, area, and you can leasing income, following use our very own rental earnings hand calculators to find out how lucrative your own options are.

You’ll be able to play with Visio Lending’s DSCR calculator , that leave you an easy proportion that shows how good the home will take care of its expenses, instance home loan repayments and you can fix. These tools is actually a significant area of the mining processes before you means lenders.

Start the program Processes

When you have understood a possessions and you will ascertained their creditworthiness to possess financing, you can start making preparations the files. To have an excellent DSCR loan, you don’t need to individual finance suggestions including tax returns, shell out stubs, otherwise bank comments: most of the we truly need with regards to your financial things was your credit rating.

The papers a business must score a DSCR mortgage is comparable to the house or property, such lease agreements and an assessment, which ultimately shows whether it’s to make sufficient currency to invest in the fresh new financing. You could feedback most of the papers we are in need of to the our very own FAQ.

You will then finish the software and fill in the mandatory records. All of our procedure is fast: you can get acceptance inside 21 months otherwise smaller, which will help your stand aggressive in the industry. At the same time, you need to cautiously remark the financing terminology, such as for instance regarding your amortization several months.

In the place of mortgage loans, DSCR finance enjoys prepayment penalties: this means that for folks who afford the loan very early, make an effort to pay a share of loan amount as well as your own fee. Which assures the financial institution can be recoup the increased loss of money they would have made of the speed on the repayments.