Home owners residing in Hawaii are given disregard home guarantee fund & fixed rate next mortgage loans for cash aside and highest financial obligation refinancing Hawaiian people can enjoy deal household collateral and you may home loan refinance money offering cash-out for good & bad creditpare Banking institutions and you can loan providers offering family collateral personal line of credit Their state.

How much Do you want to Obtain?

BD Nationwide have a tendency to introduce you to mortgage brokers you to definitely focuses on 100% domestic refinancing, HELOCs and household security money when you look at the The state to possess household remodeling, paying and you may merging credit debt and money that have highest interest levels.

Shop Prices and get Hawaii Domestic Collateral Financing having Aloha

Re-finance having a predetermined Price Mortgage loans House Collateral Finance so you’re able to 100% Their state Jumbo Lenders in order to $5,000,000 Collateral money to possess Debt consolidation Tax-deductible 2nd Mortgage loans second Home loan to have Design Low-rate Attention Only HELOC’s 2nd Family Get Fund

Think financing certain home improvements like space enhancements, home remodeling https://cashadvanceamerica.net/loans/tribal-installment-loans/, and including the fresh new swimming pools, roofs, otherwise surroundings is also significantly enhance the property value your home. Not just that, they boost both the morale and you may aesthetics in your home! You can even cash out and make use of the funds to invest in knowledge or take that much-required family vacation. The choice try your own personal, and we also is right here to help!

How come an effective HELOC work in The state?

A great HELOC works much like credit cards: You can make withdrawals as often as you wish, doing their borrowing limit. (Some Hawaiian loan providers ount.) As you repay people outstanding balance, the offered credit try replenished accordingly. Shop and you may examine household guarantee interest rates with this state guide.

What is the Hawaii Fixed Rates HELOC loan?

** Following initially repaired identity of your The state HELOC loan enjoys an apr (APR) might possibly be determined by the worth of a list along with a great margin. The latest list made use of ‚s the Primary Price since penned on the Currency Pricing line of one’s Wall Path Log. Brand new Annual percentage rate may differ quarterly, with a max restriction of % or perhaps the legal limit, any sort of is gloomier. To start the HELOC account you may be required to pay certain closing costs or charge, and this generally range between 1% and you may cuatro%.

All of our HELOCS and security funds are thought 2nd mortgages and can getting that loan and the financial you already have. Consider refinancing any rotating membership that have changeable rates of interest that have a fixed rates domestic guarantee mortgage that will optimize your monthly offers.

Regional Information Out of Hawaiian Home loan Benefits: Fixed price household equity fund try where its in the when you look at the 2024, as provided increased The state HELOC pricing a lot of moments the latest last few years that fixed appeal is in fact lower than variable speed personal lines of credit. Perform some math cousin. Yards. Plant, Hawaiian Financing Administrator at The state Mortgage company

BD Across the country will bring house equity financing getting area residents with a and you will bad credit. Hawaiian residents is also select fixed or changeable rates of interest when it comes to refinancing selection.

Make use of the current low interest, and think a hawaii second financial which enables one continue your current low-rate very first mortgage.

Pros and cons of going a property Guarantee Mortgage within the Their state

A house security loan lets home owners so you’re able to borrow on the fresh new collateral they’ve got built up within possessions, providing a lump sum of cash that can be used for individuals intentions, such as for instance renovations, debt consolidating, or other tall expenses. When you find yourself family security funds are an invaluable monetary equipment, it is important to consider the pros and downsides, especially in Hawaii, where housing market has its own unique attributes.

Masters of going a house Equity Loan inside Hawaii

The state has many of one’s large possessions thinking throughout the United Claims. If you’ve owned your property for several years or features oriented tall security, you can probably accessibility most currency because of a family collateral mortgage. That is utilized for big expenses for example home renovations, repaying loans, otherwise resource knowledge.

Home collateral loans usually include fixed rates of interest, definition your instalments will continue to be consistent regarding mortgage label. Inside Hawaii’s changing housing market, that have a predictable payment offer financial balance.

By using our home guarantee mortgage to have home improvements, the interest paid off towards the mortgage tends to be tax-deductible. This could improve loan so much more pricing-energetic, particularly when you’ve planned enhancements which can raise your residence’s worth.

Versus personal loans otherwise handmade cards, family collateral fund are apt to have all the way down interest levels. Since loan is actually protected by the house, loan providers generally bring a lot more good conditions, making it a cheaper option for credit large volumes of cash.

Disadvantages of going a home Equity Mortgage from inside the Hawaii

Due to the fact a house security loan was covered by the property, neglecting to generate repayments could cause foreclosures. Given Hawaii’s highest assets opinions, the newest bet is actually even higher. Consumers have to be confident in their capability and make consistent payments.

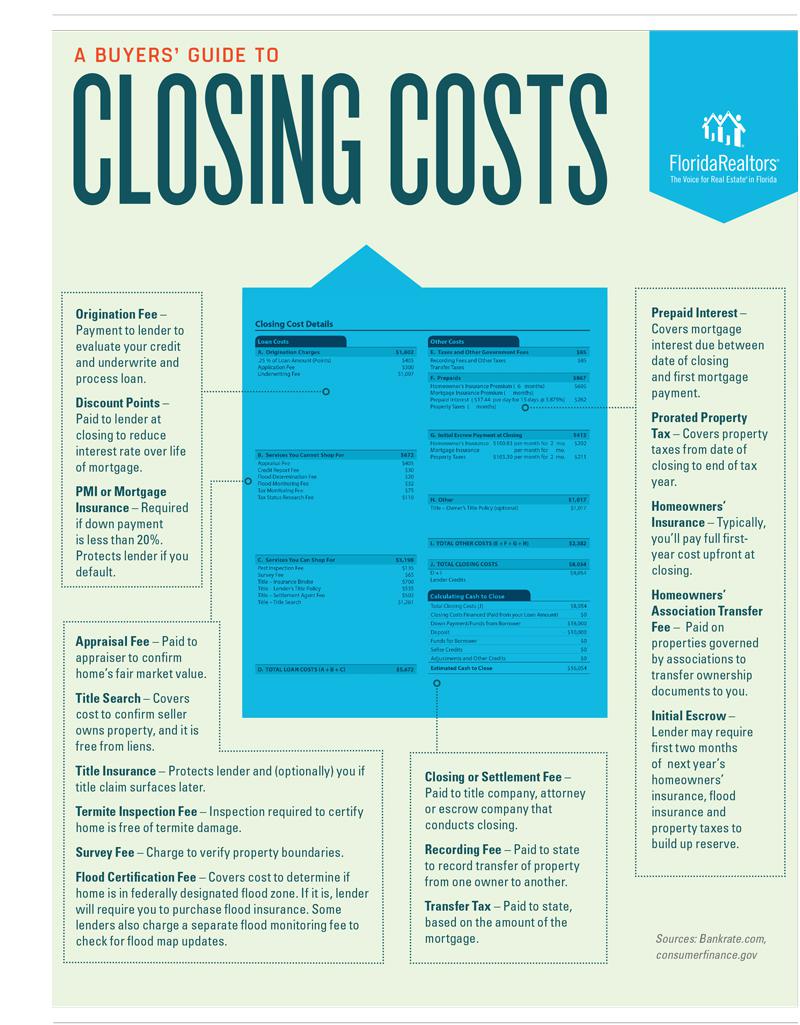

Settlement costs to own house guarantee money might be significant, especially in Their state, in which real estate-associated costs are usually greater than the fresh national mediocre. These types of family equity financing closing costs can be eat towards advantages of your financing, specifically if you try borrowing from the bank a smaller amount.

While you are Hawaii’s housing market keeps usually liked, it is subject to monetary downturns like most other sector. When the possessions viewpoints refuse, home owners might find on their own under water, owing more the value of their home.

A home security mortgage grows your current personal debt weight. When the utilized irresponsibly, you could end up inside a monetary join, especially in a premier-cost state particularly Their state.

A home collateral mortgage will be an excellent economic option for residents inside The state, offering usage of significant loans in the apparently low interest. However, additionally, it comes with risks, such as the potential for foreclosures and you may field movement. It is vital to meticulously have a look at the money you owe together with The state real estate market before carefully deciding if a home collateral mortgage otherwise HELOC is right for you.