Prevent delivering trapped paying several mortgage loans when purchasing your upcoming domestic.

If you plan to offer your residence and buy a new, which will you are doing basic? If you promote earliest, you will end up under time pressure to find another type of family easily-and may even become settling for below you desired, overpaying, otherwise having to stuff on your own and all your property towards the an effective college accommodation if you don’t can acquire a unique set. However,, if you buy first, you’re going to have to scramble to market your old house-a certain condition if you want to rating a high price for the the latest marketing to produce the latest downpayment into the new one.

Managing several properties at the same time is no lose, possibly, in the event it’s for a short time. You are going to need to care about a couple mortgages-regarding the unlikely event one a lender is even happy to offer home financing to possess an additional family before you have sold the initial-including double the maintenance, in addition to protection conditions that feature leaving you to definitely domestic blank.

Grab the Homes Market’s Heat

Just before placing your residence in the business or investing to get an alternate one, investigate the prices away from homes about places that you’ll end up both selling and buying. In order to learn how to promote high and purchase lower, you want an authentic idea of how much cash similar homes are going for.

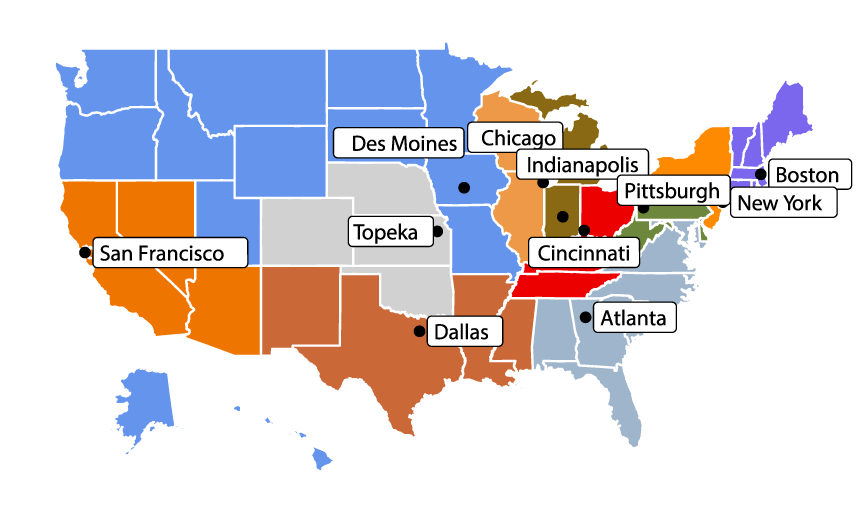

In addition to work on perhaps the local housing market try „hot” (favors suppliers) otherwise „cold” (likes customers). Just like the you will be both a buyer and a supplier, you will need to manage yourself on your weakened character while making more of the more powerful character.

If marketplace is cool, you are in a healthier status once the a buyer than due to the fact an excellent seller. You could have had the get a hold of regarding lots of house on the market, within affordable prices. But you possess problems selling your personal. To safeguard oneself, you might start by buying one minute household, then again inquire the vendor and then make you buy deal contingent on their attempting to sell your current household. A vendor with a tough time shopping for a purchaser is probable to just accept it backup, while it form in store discover a buyer. Expect you’ll provide the seller probable reason your property will promote rapidly.

However if zero seller is actually happy to take on that it backup, not, no less than be sure to normally strategy financing. Communicate with a mortgage broker about what you’ll qualify for. After that anticipate to act rapidly to place your basic home on the market immediately after heading in the future that have buying the second you to definitely. There is a lot you can certainly do in advance, particularly taking good care of repair activities, dealing with records toward instrument guides and other data you are able to give the client, choosing a realtor and perhaps a house stager, etc.

Procedures inside an excellent Seller’s Housing market

During the a hot business, promoting your house will likely be simpler than simply buying another you to definitely. To make sure you try not to end up household-quicker, you may want to start by selecting a home in order to purchase, next align enough bucks-using the actions demonstrated below-to help you wave you over into the allegedly short period the place you own two households at a time.

If you cannot swing eg a plan, but not, you might discuss along with your home’s buyer to have the selling price are a supply making the closure contingent on the looking for and you can closure for the a unique home. Whether or not few consumers will invest in an unbarred-ended several months, some might possibly be so desperate to buy your home that they can commit to impede the brand new closure if you do not romantic towards the a different sort of house or up until a specific amount of months solution, any type of appear first.

Be also certain to completely check out the field before you sell, to make sure that you will end up a competent consumer, who are able to provide the best speed towards attractive terms and conditions.

Bridge Investment: How exactly to Individual A couple of Properties Temporarily

Imagine if you happen to be not able to very well dovetail this new product sales of 1 house with the acquisition of another? You might individual zero house for a while, in which particular case you should have cash in the bank and can you want a short-term spot to live. Or you could individual a few homes at the same time. The following tips should help you handle like juggling acts:

When you yourself have relatives who possess sufficient free bucks to make investments, them financing you currency you will definitely suffice both their appeal and your very own, specifically if you give to spend a competitive interest. Claim that you need let just for a short span, as well. Supply the person deciding to make the mortgage a good promissory notice, safeguarded by the second financial (deed out of trust) in your new house. Try to set it up to ensure that zero monthly payments was owed up to very first domestic carries. End up being informed, but not, one based on your financial situation, organization mortgage lenders might decline to accept financing https://paydayloancolorado.net/ellicott/ in which the deposit does not are from your info.

Score a link financing regarding a financial institution

When you yourself have few other alternatives, it may be you’ll so you’re able to borrow funds regarding a bank or other bank to help you link the period ranging from when you personal for the your house just in case you earn your finances regarding sales of dated one to. This idea is you pull out a primary-label loan in your established home, deploying it for the this new down payment and closing costs on the new home, and you may paying down it should your basic home offers.

Bridge money can, however, getting so much more pricey than just typical home loan or home equity money (highest initial repayments also interest rates), and they’re not easy in order to be eligible for. You’ll need an abundance of collateral in your most recent house and enough income to pay both mortgage payments indefinitely. Certain requirements just about negate the advantages of the borrowed funds.