Divorce proceedings try stressful or painful with techniques, and you may determining tips pay your property guarantee towards the partner cannot create any much easier.

You have likely a home loan speed throughout the 2-3% range if you ordered or refinanced in advance of early 2022. You don’t want to sell our house, pay charges, then get again at the eight% or maybe more.

What’s on this page?

Once you splitting up, the courtroom you are going to let you know that brand new partner try entitled to 50% of your existing guarantee on house.

For example, for those who have a house value $five-hundred,000 and you can an excellent $two hundred,000 home loan balance, the home have $three hundred,000 for the guarantee.

The fresh new court you are going to say for each mate are permitted $150,000 of the. It appears fair, however, taking one $150,000 in the money is tough. You have got one or two maybe not-so-great alternatives:

You could sell your house: However your eliminate on ten% of your residence’s entire well worth so you can agent earnings or any other charges. Following, both you and your ex-mate need pick once more, taking on large home loan cost and a lot more closing charges.

If these choices are off of the table, it’s time to move to a beneficial HELOC. Which have a great HELOC, you could potentially make use of as much as 100% of your own home’s current worthy of. Here’s how.

Should you get a good HELOC to possess a divorce proceedings payout?

Your open a different sort of HELOC getting 50% of your guarantee ($150,000) in no time sufficient reason for pair closing costs. Within just days, you could have the cash to your commission.

New HELOC is placed on top of your first mortgage. For this reason talking about often called 2nd mortgages. Very first financial https://paydayloancolorado.net/brook-forest/ does not improvement in any way.

What if There isn’t plenty of collateral on house?

So, can you imagine you really have a beneficial $three hundred,000 home with a good $250,000 mortgage inside it. That’s $50,000 during the guarantee plus the court states your lady try entitled so you’re able to $twenty-five,000.

Who would bring your total of all of the financing to $275,000, or ninety-five% loan-to-worthy of. This is when brand new HELOC extremely shines. Zero lender will give you a funds-away re-finance around 92% LTV. But some HELOC loan providers commonly.

Therefore even though you have little equity at your home, there clearly was a good chance good HELOC can deal with the new divorce payment commission.

Analogy guarantee and you will commission situations

Here are examples of how HELOC means can enjoy aside. Which assumes a fifty% separated away from family guarantee, but your courtroom ruling tends to be various other.

*Prices is actually eg objectives merely and may even not be offered. Submit an application for your house equity capital for your qualification and rate.

*Pricing was particularly intentions merely and may also never be offered. Apply for your residence security resource for the qualifications and you will rates.

Envision property equity mortgage instead of a great HELOC

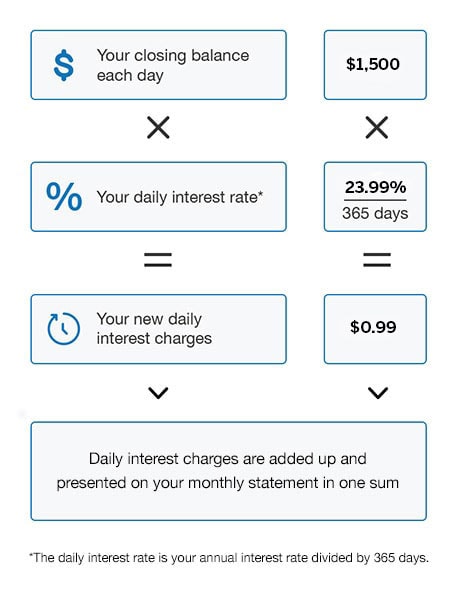

These finance try variable and you will according to the primary speed. At time of so it creating, the prime rates try 8.25%. Finest rate actions up with the fresh new Government Reserve brings up its key interest.

Already, the fresh new Provided is on an effective warpath to battle rising cost of living. Although it have backed-off their competitive speed-hiking steps, it still get hike rates because of the 0.25% or higher along side coming days. Thus a beneficial HELOC having a performance out-of best + 0.25% might possibly be 8.5% now but could be 8.75-9% by the year’s prevent.

Its eg a home collateral range, it a fixed contribution and comes with a fixed rates. You’ll be able to spend a higher rate on fixed mortgage, but it eliminates the possibility of a skyrocketing HELOC speed.

But don’t dump the notion of good HELOC. Most lenders enables you to secure a share otherwise the of HELOC shortly after closure. Check with your lender or borrowing union on their rules from the an article-closure lock.

Simple tips to understand worth of the house

In the process of obtaining HELOC, ask the financial institution when they manage a complete assessment. Once they perform, there clearly was likely an estimated $five-hundred fee because of it. While which is a drawback, luckily which you yourself can has actually a 3rd party elite viewpoint of the home worth.

Either, though, the new HELOC lender won’t order an assessment. They have fun with a keen AVM automatic valuation design. These are not always appropriate.

We never ever spend money on an assessment except if he could be bringing a loan and it’s required by the financial institution. But you can to purchase your very own appraisal. Simply do a fast Google search to possess a keen appraiser on your city.

Pros and cons out-of good HELOC to have separation and divorce

- Wake up in order to a great 100% joint financing-to-well worth

- Stop agent earnings and you will charge that include offering the house

- Don’t have to buy again in the higher cost

- End losing your existing reasonable number one home loan rate

- You happen to be in a position to secure an increase after closing

- A great HELOC does not take away the wife or husband’s term about very first mortgage.

- You are going to need to qualify for the first and you will second home loan repayments when obtaining the brand new HELOC

- HELOCs include adjustable prices which can be rising

Splitting up payment HELOC FAQ

HELOC costs should be more than top home loan rates. He could be in line with the best speed, that could increase anytime according to Provided motions.

Many lenders enables you to protect most of the otherwise part of the HELOC balance immediately following closure. You can also get a home equity loan, that comes that have a fixed price.

Of numerous loan providers allows you to availableness as much as 100% of your home’s guarantee. So if you reside worth $300,000 along with a $250,000 mortgage, you might be eligible for an excellent HELOC from $50,000 for people who be eligible for brand new costs and you may satisfy other requirements.

Find out if a beneficial HELOC getting a separation payout is right to possess your

Our very own advise is dependant on expertise in the mortgage business and we are intent on assisting you reach your purpose of possessing a house. We possibly may found settlement from mate banking companies when you glance at financial pricing listed on all of our website.