Residents selecting a means to accessibility a giant sum of currency may not have to look past an acceptable limit whether they have compiled security in their house. And, this currency is often borrowed during the a comparatively low interest rate.

What is actually family guarantee?

Domestic guarantee ‚s the percentage of your home that you’ve paid down out of. Simple fact is that difference between just what house is really worth and how far is still due on your own financial. Since your home’s worth expands over the longterm and you also reduce the main with the financial, your own guarantee grows. Family collateral is typically utilized for huge costs and sometimes represents a more pricing-active investment option than simply credit cards or personal loans with high interest levels.

How domestic security really works

Scraping your property collateral shall be a handy, low-cost treatment for acquire large sums on positive rates of interest when you look at the acquisition to cover family solutions or debt consolidating. But not, the right sorts of loan utilizes your unique demands and you can what you are considering making use of the currency for.

- Property security credit line (HELOC) is actually a changeable-rates https://paydayloancolorado.net/sanford/ family collateral financing that actually works instance credit cards. Having a great HELOC, you may be considering a rotating personal line of credit that can be found for a great preset time frame. HELOCs enables you to spend as you go and just shell out for just what you have lent.

- That have a house guarantee loan, you obtain a lump sum of cash at the start you need initiate repaying quickly. Domestic security financing provides fixed interest rates, definition your repayments may be the exact same per month.

- Cash-aside refinancing brings a different, huge financial on the home. You will use this financial to settle your own old you to and you can remove the real difference during the cash.

Best ways to explore a property equity mortgage

You will find not too many constraints about how precisely you can utilize your home’s equity, however, there are some wise a way to take advantage of the loan otherwise line of credit.

Home improvement the most popular explanations homeowners just take away home equity loans otherwise HELOCs. As well as while making a property easier for your, improvements may increase the residence’s worth and you can draw significantly more appeal out of possible customers when you sell it after. Most other home improvements you to definitely give a substantial return on the investment become garage and you can entry door substitutes, a special patio, another roof or a backyard town inclusion, such a patio.

A house security mortgage or HELOC is generally a great way to cover a college education. If you find yourself student education loans are nevertheless the most famous cure for shell out to have a knowledge, the aid of household guarantee can still be useful when home loan cost try considerably below student loan interest rates. In advance of tapping your house equity, but not, evaluate all the alternatives for figuratively speaking, such as the conditions and you can interest levels. Defaulting into the a student-based loan often harm their credit, but when you standard towards a house guarantee financing, you might get rid of your residence.

Also, if you’d like to financing your own infant’s degree having a house collateral mortgage unit, definitely calculate the latest monthly obligations in the amortization months to discover whether you might pay-off it personal debt prior to senior years. If this will not hunt possible, you can get youngster pull out a student financing themself, as they begin to have numerous more income-and work out age to settle the debt.

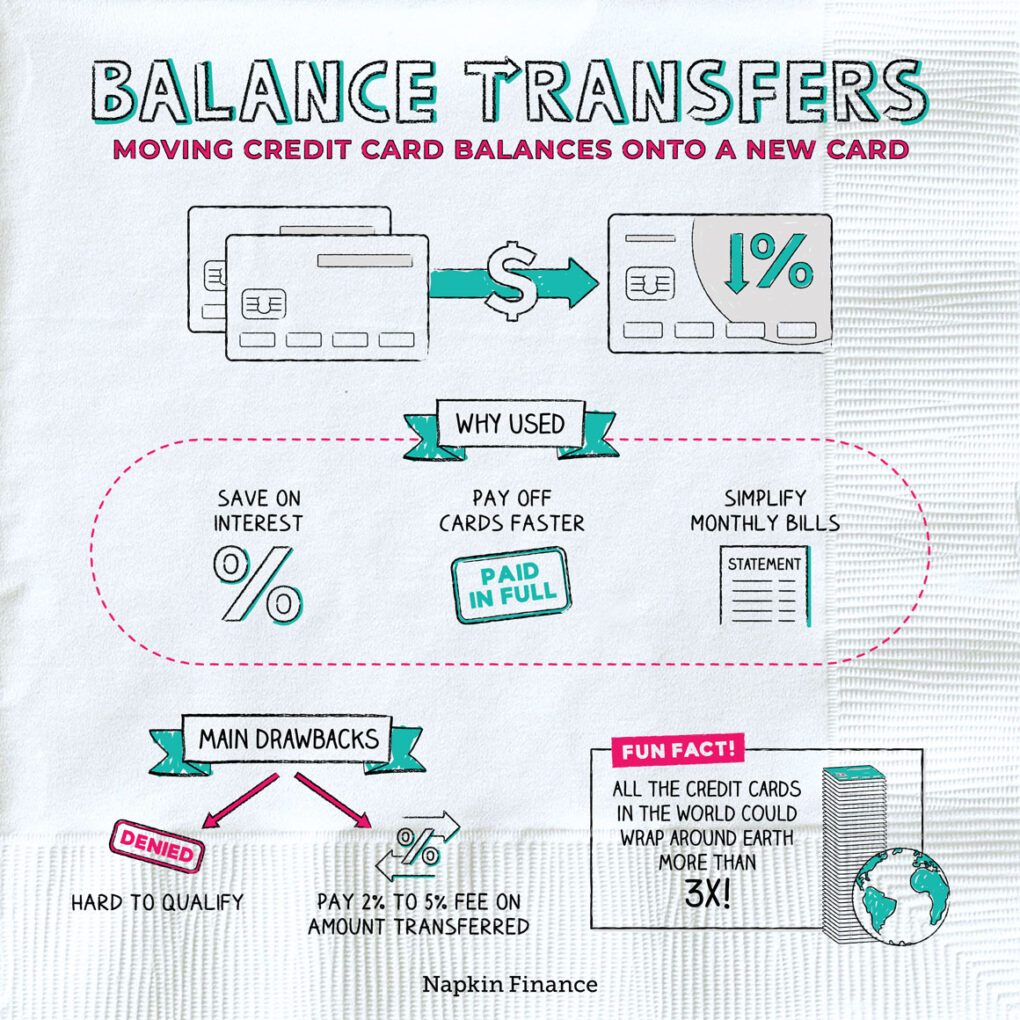

A good HELOC otherwise household security mortgage are often used to consolidate high-attention loans on a diminished rate of interest. Residents both have fun with family collateral to settle most other individual costs, like a car loan otherwise a credit card while they are in a position to combine obligations in the a much lower rates, more than a longer identity and relieve the monthly expenses.

The newest drawback, not, is the fact you happen to be flipping a personal debt, including a charge card that’s not backed by people equity, to the a protected financial obligation or financial obligation that’s today backed by your property. In addition, you exposure running in the credit cards once again immediately after having fun with family collateral money to expend them out-of, significantly enhancing the amount of loans you’ve got.

If you have too much consumer debt with a high rates of interest and you’re having trouble deciding to make the costs, it may seem sensible so you’re able to combine you to loans on a considerably lower rate of interest, protecting oneself currency per month. When you yourself have a good debt rewards plan, playing with household guarantee to help you refinance high-desire debt can help you get out of personal debt less.