These types of shady people you will state they lose negative ideas in your credit report straight away

Along with expenses on time and you may lowering your expenses, definitely look at the credit file. This new Federal Change Percentage (FTC) cards you to doing 20% of all the credit file provides wrong advice. This is an incorrect target or a documented fee towards the unsuitable membership. It does is discussing data that have anybody regarding a similar title, otherwise an incorrect Public Shelter matter. With respect to the the amount of one’s error, an inappropriate suggestions can reduce your credit history.

You might request a copy of credit history during the AnnualCreditReport. Individuals are permitted a free credit report the 12 months. If you discover people incorrect information about the file, you ought to dispute the fresh new error towards credit scoring company. Explain the error thru authoritative letter, and you will install documents who does assistance their claim. Understand much more about tips conflict credit file problems, look at the Individual Fund Coverage Bureau (CFPB) web page.

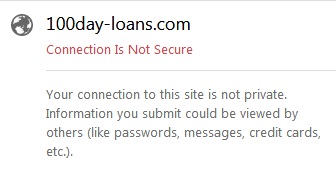

During the bankruptcy proceeding or foreclosures, you could potentially look for credit repair techniques who promise to improve your credit score. They may also bring to improve your credit rating of the accompanying your credit history with an alternative individual who has got good credit get. Which practice, named piggybacking,’ is illegal whenever done instead of a valid connection with a individual. It is quite experienced ripoff if you on purpose do so so you can misguide banks and other credit institutions.

The only way you can improve your credit score will be to do the functions. Build costs on time and reduce the money you owe. The fact is there’s no small answer to develop your own credit. To cease next activities, you need to abstain from credit fix cons.

On center regarding enhancing your credit score is a good loans fees means. Yet, you need to surely initiate tossing your finances. This may voice daunting, particularly when you are not always monetary considered or setting costs. Anyone else also are unmotivated into the prospect of calculations and you may reducing off expenses. Although not, here’s an easy method so you can reframe the direction: Cost management is life within your mode when you are being able to pay for your desires.

Cost management are a method of reducing your costs when you are enhancing your income. That it begins with while making a list of extremely important date-today costs, and you can segregating all of them away from low-very important discretionary will cost you. As a rule regarding flash, you must always prioritizes crucial requests more than points that are perfect for, but not necessary. Essential expenses include things like food, utilities, book, transportation, and you can earliest can cost you you desire to own daily living. Non-essentials security anything from sweet clothing, footwear, dining out, welfare, vacation, etcetera.

The fresh new FTC says that up to 5% of consumers has actually credit file problems that will trigger undesirable mortgage sales

Assess your month-to-month money. Record down simply how much you spend per month. After that, factor in simply how much loans you pay you need to include that on your own very important expenses. Once you create your number, you have a so good idea just what products your usually invest in, and and therefore costs you might acceptance. From that point, you can to evolve your financial budget and come up with place for loans payments and you can deals.

Reduce a lot of costs such as eating out, particular hobbies, otherwise to get the latest attire. Some people and additionally love to book within affordable where to maximize its savings. When you need to lose transport can cost you, it’s also possible to get public transit when you yourself have an available shuttle or instruct station near you. Finally, if you intend to acquire a https://paydayloanflorida.net/sky-lake/ property soon, make sure to budget for offers to get enough deposit.