When deciding on a licensed moneylender into the Singapore, numerous things should be believed. Below are a few the best thing knowing before you choose good licensed moneylender:

Facts Interest levels

Perhaps one of the most issues to consider when selecting an effective registered moneylender ‚s the interest it charges. Singapore’s moneylenders can charge a maximum interest rate out-of cuatro% a month. If you acquire $step 1,000, you’re going to have to pay back $step one,040 at the end of the latest times. Be sure you comprehend the rate of interest and just how it can connect with their monthly installments prior to signing any loan agreement.

Registry away from Moneylenders

To ensure that you are dealing with a licensed moneylender, you should check the newest Registry off Moneylenders handled because of the Ministry of Laws. Which registry contains a listing of all-licensed moneylenders within the Singapore. You can also find out if new moneylender you are dealing with is found on the list of signed up moneylenders. Understanding that youre writing on a legitimate moneylender gives your reassurance.

Avoiding Financing Cons

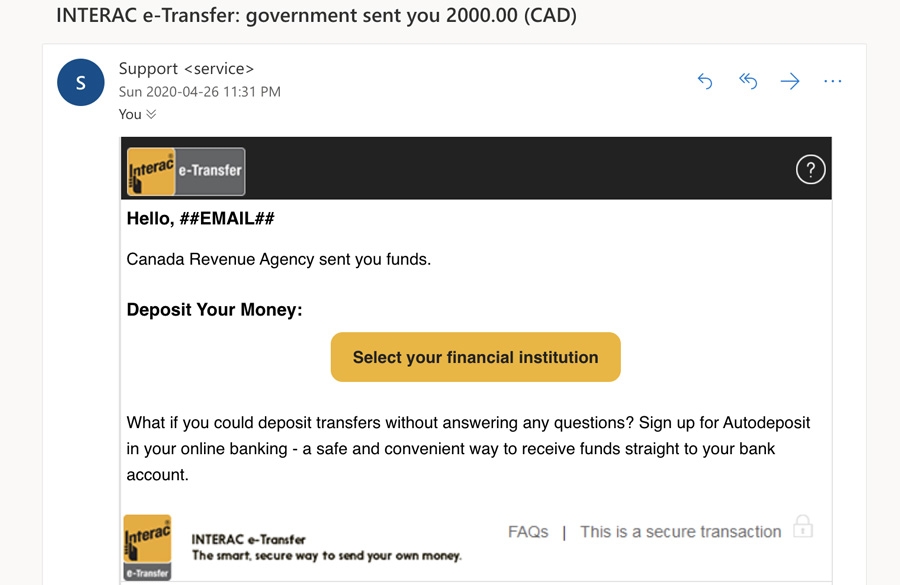

Financing frauds are typical within the Singapore, and you may awareness of all of them is key. Some loan scams get include unlawful moneylenders who charge extreme attract cost and use illegal answers to assemble costs. Often be cautious with loan also offers that seem too good so you can feel genuine. While you are not knowing from the financing promote, take advice from new Registry out of Moneylenders otherwise get in touch with brand new Ministry out of Rules to possess advice.

As well, you’ll be able to look at the customer care score of subscribed moneylender when you borrow from their website. This will guide you just how some other clients found the feel to your moneylender.

By taking enough time to learn the interest prices, checking new Registry regarding Moneylenders, and you can to prevent mortgage frauds, you might come across a licensed moneylender that is correct to you personally.

Making an application for that loan inside the Singapore as a-work enable manager is going to be overwhelming, but best planning is going to be a soft and effective techniques. Here you will find the actions you ought to follow to apply for a loan out of a Singapore money-lender.

Files Requisite

Upfront your loan software processes, you should make sure you have all the required documents offered. Including the passport, evidence of household, and you will a recently available household bill. Additionally need certainly to give proof money, such as payslips otherwise a page out of your boss.

Having fun with SingPass to own Apps

Of many Singapore currency lenders allows you to sign up for that loan on line using SingPass. SingPass are an online authentication program enabling you to availability various regulators e-qualities. After you make an application for a loan using SingPass, you might steer clear of the problem regarding visiting the lender’s workplace in the people. You may want to save your time and effort of the submitting all the expected papers on line.

Approval and Disbursement

After you’ve filed the loan software, the financial institution tend to feedback the application and you can records. When your software program is recognized, the financial institution often disburse the loan add up to your finances. The mortgage disbursement processes usually takes a short while, according to the lender’s processing go out.

To summarize, making an application for financing away from a great Singapore loan provider just like the a functions allow manager is an easy techniques demanding proper documentation and you may thinking. Following the fresh new steps detailed significantly more than, you can improve possibility of getting the financing approved and you can paid rapidly.

Money-lender Singapore to possess Functions Permit Proprietor: Financial Believe and you can Management

Bringing that loan of an excellent Singapore money lender just like the a work permit manager is actually a life threatening financial choice that requires careful believe and you can management. Here are a few secret what you should recall: