LightStream offers unsecured signature loans having payday loans Fort Deposit no credit reduced repaired interest rates. These types of funds might be best suited to borrowers that have a beneficial otherwise sophisticated borrowing from the bank. Wondering in case it is a knowledgeable lender available? That it Lightstream opinion offers a closer look at the exactly how this type of loans functions and you may exactly who they can be right for.

Compare LightStream some other Credit Companies

Naturally, LightStream possess competitors during the top quality of your business. And lots of advertises a reduced costs. Of course, the trick would be to compare customized personal bank loan quotes discover a ideal render.

Unfortunately, many that happen to be shorter creditworthy can get stand absolutely nothing options using this lender. Thus why don’t we mention certain choice that may confirm perfect for you, no matter your credit score.

Update

Enhance has the benefit of unsecured loans as high as $50,000 getting qualified individuals, together with those with less than perfect credit. Posting financing are generally used in debt consolidation in addition they do carry a loan origination fee ranging from step 1.5% so you’re able to six%.

Rewards

Incentives was a peer-to-fellow financing markets giving fund as high as $thirty-five,000. These funds may be suited to borrowers regarding reasonable credit score range who are in need of shorter loan numbers.

LendingClub

LendingClub now offers signature loans as high as $forty,000 with payoff regards to thirty-six otherwise sixty days. Which lender works closely with individuals that have poor credit, but you can expect to pay increased interest to have that loan.

- Do it yourself plans otherwise fixes

- Debt consolidating

- Large instructions

- Scientific costs

- Relationships costs

- Auto solutions otherwise purchases

- Holidays and you may timeshare rentals

- Watercraft otherwise Rv instructions

Very, exactly who qualifies for good LightStream personal bank loan? When you are LightStream doesn’t disclose details on minimal credit history or money conditions, they generally find individuals who have:

- Many years of credit history

You could potentially nevertheless make an application for a good LightStream unsecured loan if you enjoys reasonable otherwise bad credit if not no credit whatsoever. It are harder to find acknowledged. If you’re recognized, the loan can come having a top interest, very which is something to think.

How to Incorporate That have LightStream?

It is easier than you think to apply for an unsecured loan with LightStream. You certainly can do thus on line by finishing the application form. You’ll need to express particular personal and you can monetary pointers, together with your:

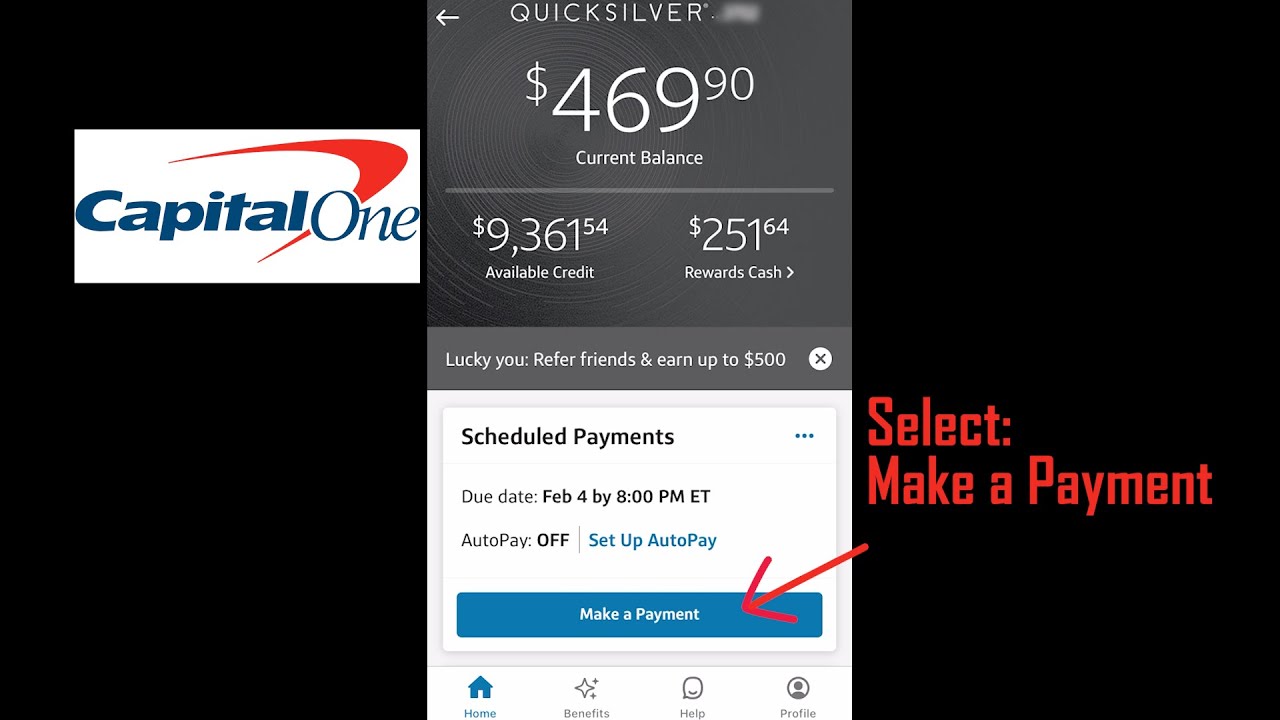

You will additionally must give LightStream how much cash we wish to use, your preferred loan installment title, and if you would like to register for AutoPay to find an interest rate discount. If you decide to not ever, you could potentially still help make your loan repayments by hand monthly on line otherwise from the LightStream application.

LightStream will not supply the option to check your price before you apply, you could utilize the rate calculator in order to guess financing words. This will help you determine whether you truly wanted to make use of according to everything you you’ll shell out.

When you fill in the application, LightStream functions a hard pull of your own credit history. If you find yourself acknowledged, you could give your money matter and routing number to get financing proceeds transferred.

Just how Soon Should i Rating My Money Having LightStream?

LightStream is not surprisingly pleased with being able to get the money to you personally quickly. Certain borrowers found their cash on the same day they use. According to small print to your lender’s webpages:

You could fund your loan today when the today was a financial working day, the application is eligible, and you also complete the following strategies of the dos:29 p.meters. Eastern date, if you what you should do:

Score the characteristics

Regarding people personal loan financial, you will need to glance at the features and you can gurus you might see. Here is what you can expect that have a LightStream financing.

Consumer experience

Trying to get a personal bank loan with LightStream is straightforward while the webpages is additionally user-friendly. The largest disadvantage may be which you can not look at the prices very first before applying. In terms of feedback and you can evaluations, LightStream has many positive reviews away from met individuals.

Charge and you can cost

LightStream the most percentage-amicable consumer loan loan providers, no origination costs, zero prepayment charges, without later charge. The variety of rates given are wrote on domestic webpage, regardless if once more, you simply will not know very well what rates you can easily qualify for unless you use. You can purchase a great 0.50% AutoPay speed discount from the indicating that you want to enroll inside the AutoPay once you complete the application form.

Openness

LightStream try transparent about how exactly its financing functions, whatever they can be used for, what’s expected to incorporate, and just how much you can easily pay for costs and you can interest. The site provides an in depth FAQ area which explains this new finer circumstances out of credit with LightStream in detail.

Autonomy

You actually have certain independency here in terms of just what finance are used for. If you’re playing with an effective LightStream loan to possess debt consolidation, yet not, it is very important keep in mind that there’s no selection for lead costs so you can financial institutions. It indicates you’ll need to be responsible for having fun with loan continues to repay per obligations we should combine.

Customer service

Borrowers normally manage the LightStream financing on line otherwise from the LightStream mobile application. The new application is free of charge in order to down load on the Play Shop or the new Application Shop. Customer service is present thru email address at the [email protected] Saturday by way of Monday of 10 an excellent.m. to 8 p.m. and you will Saturdays away from noon so you can 4 p.meters.

Advantages and disadvantages from LightStream

Like any most other bank, LightStream has each other particular benefits and drawbacks. Here you will find the fundamental pros and cons to consider whenever was best for you.

LightStream Faqs

LightStream do manage a challenging credit score assessment after you get financing. However, purchasing the LightStream mortgage punctually could help adjust your credit rating through the years.

LightStream cannot establish at least credit history, though individuals do need to has actually good to advanced credit. Therefore, you need a credit history with a minimum of 660 so you’re able to qualify for financing.

After you make an application for a personal bank loan with LightStream, the financial institution will try to verify your revenue. LightStream does not identify at least requirement for unsecured loan approvals.

Tips

Discover different reasons for having making an application for an unsecured loan, and regardless of why you should use, it is vital to find a very good bank for your needs.

LightStream could offer freedom, reasonable pricing, no charges to help you qualified consumers having a smooth software processes. If you find yourself happy to progress with providing an unsecured loan, you could do the second step and apply for a loan having LightStream.