Navigating the Virtual assistant loan pre approval procedure would be a life threatening action for the homeownership having veterans and you will active military users. This step besides demonstrates your own maturity to acquire a property, however, an excellent Va loan pre approval shows possible vendors brand new legitimacy of offer into the an aggressive markets.

Secret Takeaways

- This new Virtual assistant mortgage pre recognition procedure is a collaborative efforts ranging from the You.S. Institution out of Experts Affairs and you may Va-accepted private loan providers.

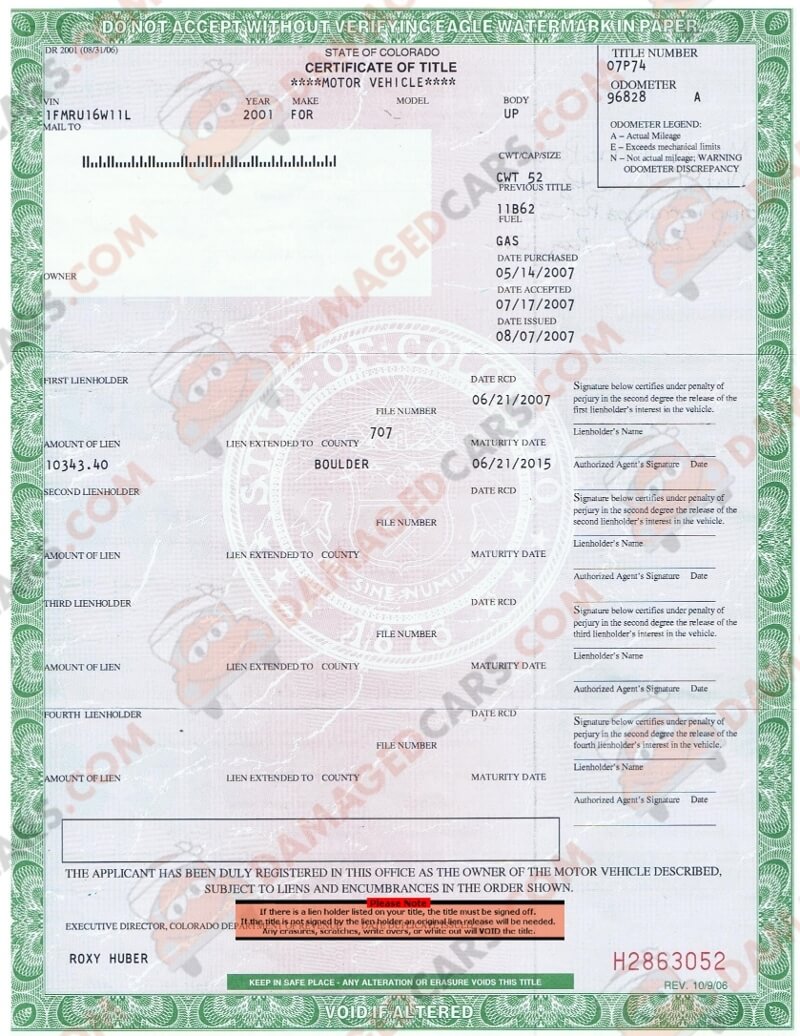

- Very important files range from the Certificate from Qualifications (COE) and you may, getting energetic-obligation provider professionals, a working Responsibility Statement from Services.

- Just the right personal bank, proficient in new Virtual assistant financing techniques, is a crucial part out of protecting an excellent Virtual assistant mortgage. The procedure relates to submission an intensive number of data files for the financial to possess assessment of one’s funds.

- Belongings for Heroes facilitate effective obligations and you may experts that are navigating the newest Va financing while the home buying techniques, and you may conserves all of them an average of $step 3,000 once closure. Signup and a member of the group commonly get in touch with your to decide how-to most readily useful last. There is no duty.

What is the Virtual assistant Financing Pre Recognition Procedure, and exactly how Can it Works?

The fresh new Va financing pre approval procedure are a beneficial preparatory step for experts and you can armed forces professionals to secure a mortgage. Due to a mix of Virtual assistant service and private lender studies, this action concerns obtaining a certificate away from Qualifications, selecting the right lender, and you will building required files for mortgage acceptance. Not merely can it pave how www.cashadvanceamerica.net/10000-dollar-payday-loan/ getting an easier family to acquire journey, but it also positions you as a critical customer from inside the aggressive locations.

When you are attempting to get a good Virtual assistant mortgage pre approval, it is best that you be aware that you ought to advance on the one or two fronts. The brand new Va financing experience a team effort within You.S. Department of Veterans Situations and you may an excellent Virtual assistant-accepted individual lender. On one side you’ve got the Virtual assistant loan program, who insures and you will promises your loan. The newest Virtual assistant cannot question the mortgage. It support both you and reveal the private lender which you are a good chance to possess a home loan. It’s a bit such as for instance which have a cosigner in your mortgage, however, healthier.

The private lender, financial or large financial company do most of the heavy lifting within procedure. They actually give you the mortgage, pre accept you into the loan, and you may service your loan for another three decades (otherwise fifteen, depending on your mortgage). In many cases, their Va-acknowledged financial could well be working with the fresh Va to track down all new approvals and you may data files in-line.

Finding the right personal bank is vital. Home getting Heroes have achieved a network off individual mortgage lenders and you may brokers that purchased dealing with pros, productive responsibility service people in the fresh new armed forces and other society heroes. We are able to assist you in finding and you will connect with financial gurus whom be aware of the Va financing processes and you will who would like to make it easier to because of your service into country.

Up top, it is preferable to store it upright and you will know very well what you prefer of each side of your techniques.

Precisely what the Va Really does to own Va Mortgage Pre Approval Processes

Going through the Va loan pre acceptance procedure mode obtaining records. The main one might listen to most on the ‚s the COE (Certificate from Eligibility). Luckily, as you create need which essential document doing your application, this is not difficult. It is simply a single page form and it’s on the web.

The new Certification off Eligibility is what it may sound like: it verifies with the Va loan processors along with your individual lender of one’s Virtual assistant financing qualifications.