Subsequently, the lending company have a tendency to carry out an affordability examine to decide how much cash they may be able indeed provide to you personally and you will what payments you could manage. This can effect things such as the put standards and financial name.

- Employment reputation, whether or not functioning otherwise thinking-employed

- Full revenues

- Typical expenses for example domestic costs

- Childcare will set you back

- Student loan costs

- Credit rating

- Expenses

- Future circumstances

Would like to know A whole lot more?

Fill out this type and we will get in touch with you so you’re able to guide a free of charge concept that have our financial advisors.

It’s worth recalling how much cash financial you can acquire as well as how much you really can afford may vary. Ergo, it is preferable to take on if you could potentially easily pay for the fresh new repayments into the a massive financial. A beneficial rule of thumb should be to prevent expenses over 30% of the money on the mortgage payments. Any further than just this may give you instead money to accomplish other things, such home improvements, build up your own savings or go on holiday.

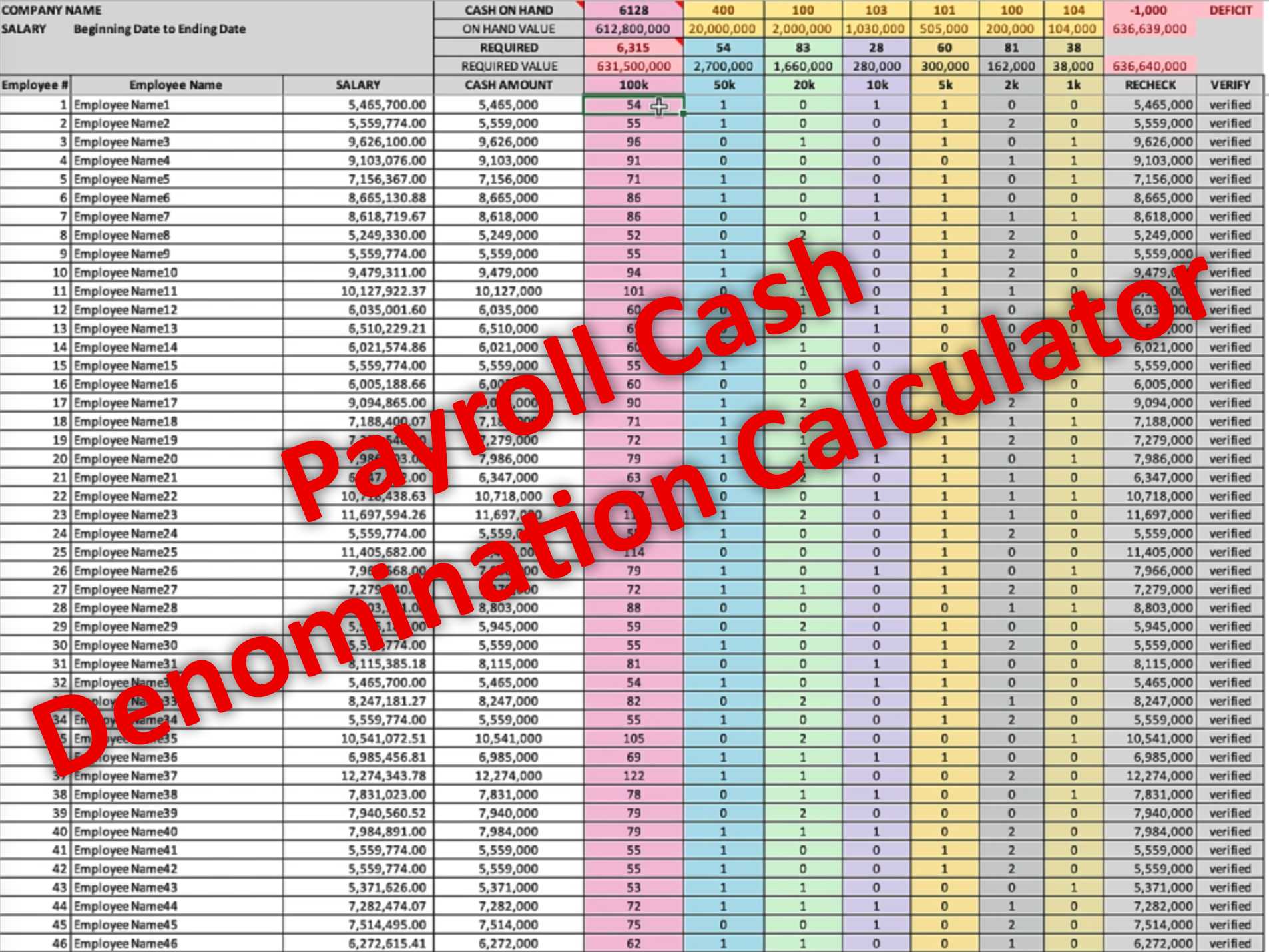

Our very own home loan credit calculator gives you an idea of just how far you could borrow against home financing according to your earnings. Whenever you are all of our cost calculator can display your exactly what your monthly installments could well be after you’ve home financing contract at heart.

When we you may all of the use doing we appreciated, we had most of the inhabit mansions and you can penthouses. Unfortunately that’s not the way it is, so to help you expose exactly how much you could obtain, the mortgage lender will need another into account.

Deposit

Their put ‚s the number you have to set out to help you safer your residence. Normally a deposit with a minimum of 5% – 10% is needed to safe a mortgage. not, you will find several organization providing very first-time client home loan product sales within 100% LTV.

The brand new more mature youre, the new less time you have to pay off your own home loan and you may this means their monthly costs would-be large on the an installment home loan.

Credit rating

Your capability to borrow funds try at the mercy of a great borrowing score. A great amount of factors make a difference your credit score, such bank card money and you may quick statement costs so it is smart to keep an eye on everything you better for the get better away from obtaining a home loan. If you’re not sure exactly what your credit history was, you should check using other sites particularly Experian and you will Equifax.

How much cash You earn

It makes sense you to definitely loan providers are more prepared to enable you to use a heightened amount of cash if you have way more throwaway money. While you are to order with a partner otherwise a pal, the mutual income and expenses was taken into consideration.

Getting with the Electoral Roll

Their home loan company can ascertain specific facts about you for individuals who try, or have been, joined so you can choose. Getting to your electoral roll is considered favourably from the lenders.

Purchasing

For many who continuously go on shopping sprees, you ought to curb Smeltertown loans you to definitely habit before you apply to possess a mortgage. In the event that a home loan company sees you have large costs and high debt they will be faster willing to allow you to acquire given that much money since you may wanted.

Just how much Must i Use? Frequently asked questions

While the amount you might obtain for home financing will vary based on your needs and the bank, you can typically expect to acquire to 4.5x your annual paycheck/money.

Such as for example, for people who secure ?30,000, you may be entitled to a home loan of ?135,000. Certain lenders are able to use a higher or low income numerous. It’s important to just remember that , loan providers often thought a great many other items in addition to paycheck when assessing simply how much you really can afford, just like your age, monthly costs, employment reputation and you will deposit size.