New prices toward a great HELOC.

- Current email address symbol

- Twitter icon

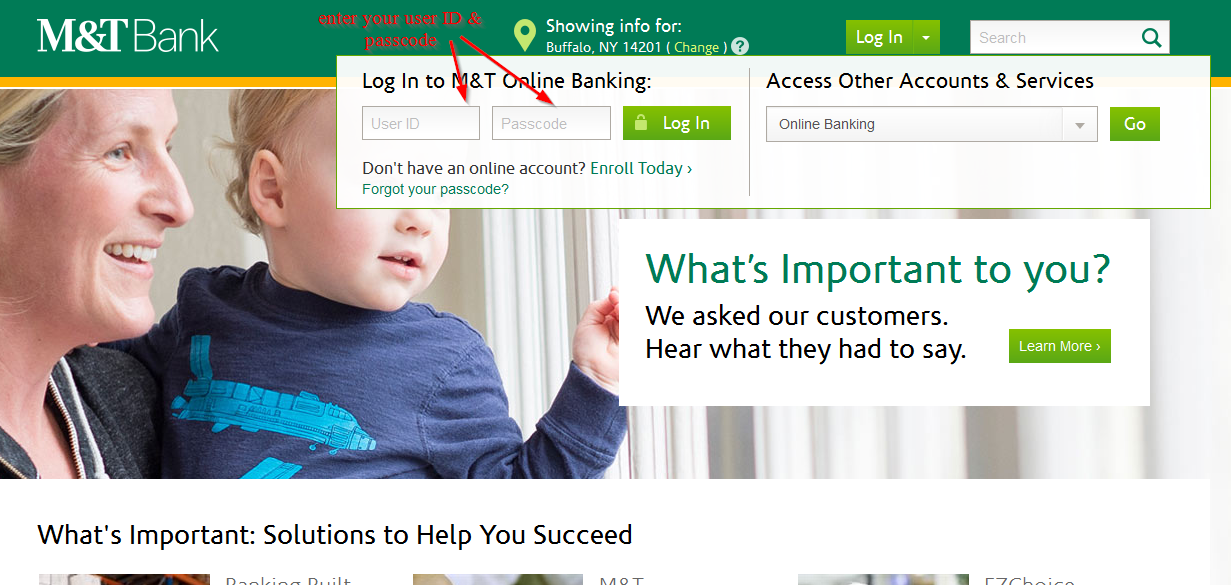

- Facebook symbol

- Linkedin icon

- Flipboard symbol

65% having an effective ten-year HELOC and you will 5.96% having good 20-year HELOC, predicated on investigation off Bankrate on few days birth Nov. step 1. (Comprehend the low HELOC rates you could potentially be eligible for here.) And several individuals will pay way less: Just remember that , the rate one a borrower will get can vary dramatically, to your typical selection of pricing open to HELOC individuals becoming ranging from step 1.89% and you may 8%, states Jacob Station, LendingTree’s elderly financial expert. If you find yourself those who are most likely to track down a rate less than 2% towards an effective HELOC try people with credit ratings regarding 760 and you may a lot more than, certainly one of other economically favorable qualities, there are lots of different ways to obtain the low HELOC price for your requirements – even if you try not to fall into one to bucket. This is how.

1. Enter into a far greater financial position

The very first thing we need to evaluate is the credit get. The better a great borrower’s score in addition to so much more equity they’ve got depending into their home, more enticing they are in order to lenders and also the apt to be he is to find good rates, says Channel. Loan providers want to see scores significantly more than 760 before giving their most aggressive pricing, benefits state, but if your credit score cannot fall-in top of the echelon, never anxiety. When you’re and come up with all your valuable money promptly and settling one revolving expense, day commonly restore new wounds. When you’re close to the threshold, and come up with a giant fee facing good rotating equilibrium or utilizing some thing for example Experian Improve you will place you across the hump apparently quickly, says Greg McBride, captain financial specialist at the Bankrate.

Loan providers and like to see a low loans-to-income proportion (this will be mentioned adding all monthly loans money together with her and you may separating them by your disgusting month-to-month income; loan providers constantly allow the ideal cost to the people with a beneficial DTI from approximately 36% otherwise shorter), enough earnings and you may a reputable fee record.

dos. Always possess at least 20% equity of your home

The greater number of collateral you’ve got, the better out of you will be. Seek to hold no less than an untapped collateral stake out of 20%, and many more get internet you a much better bargain, says McBride. Having home prices constantly ascending, the majority of people could actually fully grasp this much security without realizing they.

3. Look at the low-rate basic also provides, but know what comes second

A good amount of banking companies now have very low-rates introductory now offers. Such as for example, Bank of The united states is now providing a minimal varying basic speed of 1.990% for six months, at which point the interest rate change to cuatro.400% throughout the mortgage. Nevertheless these commonly right for group, and you should shell out consideration in order to the length of time its essentially and you may what your lowest fee was if marketing rates expires and also the speed reverts to help you their practical level, says McBride.

4. Research rates within different finance companies, like the one which keeps your own mortgage

Score cost and you may terms and conditions out-of step three-5 different lenders. Due to the fact additional lenders offer some other costs, people who shop around before installment loans for bad credit direct lenders Louisiane applying having a great HELOC then raise its likelihood of obtaining absolute best speed, states Route.

cuatro. Explore a transformation condition

As the HELOCs usually have varying cost that will change over the newest term of your own loan, particular loan providers make it borrowers to improve their interest cost regarding variable so you’re able to fixed from inside the mark period. That is of good use when interest rates was prediction to increase, because it allows a borrower to help you protected a lowered fixed rates. Additionally, specific loan providers also allow borrowers adjust returning to this new varying rate whenever rates start to disappear.

5. Be aware that it’s about more than simply this new costs

It is necessary that you also consider costs and you can settlement costs when you look at the their studies of which bank to choose.Charges and you will closing costs can vary ranging from lenders making it essential to complete side-by-side testing regarding yearly payment prices (APRs), as well as fees and something-day will cost you, states Paul Appleton, direct off consumer financing at Commitment Bank.

Be cautious about prepayment charges as well, because particular lenders penalize borrowers to possess paying its loan back before than simply arranged. That is particularly relevant for anyone exactly who might offer their residence ahead of the latest HELOC is actually completely paid back.

Also, it is secret you check if mark several months comes to an end. HELOCs generally operate on a thirty-12 months plan, with the earliest ten years serving because mark several months (the length of time you must utilize you to available borrowing) and also the last two decades providing given that repayment period. In draw several months, you’ll be able to just be needed to build attention repayments, as well as the cost several months marks the beginning of paying back the brand new prominent part of the financing. But, it’s not uncommon to possess HELOCs in the future having balloon money, or a period in the event that installment number is gloomier, with a lump-share due in the bottom. Should you decide sign up for example ones HELOCs, make certain that you’ve set aside adequate money into the finally commission.

The recommendations, advice otherwise score shown on this page are those of MarketWatch Selections, and then have perhaps not become reviewed or endorsed by all of our industrial lovers.