Buying your basic house is going to be tough, there are numerous called for strategies that you could never be alert out of, and problems are costly. But not, once the an initial homebuyer, you additionally have usage of some advantageous assets to remind individuals to get on the house or property ladder. In this post, we shall demystify the home to invest in procedure and what you would like to possess in place before you buy.

At a glance

- First home buyers have access to income tax holidays, federal financing, and you will condition programs to encourage more folks to get in the home market.

- Ahead of watching households, you have to know what you are able manage, the size of the borrowed funds you could potentially safe, what kind of possessions you want, and acquire a representative to research.

- The procedure of to buy a property boasts picking out the possessions, getting resource, and make an offer, carrying out a home inspection, and you may closure.

- Once you have purchased your residence and you will gone from inside the, you will find fix can cost you.

Just what Professionals Would Very first-Go out Homebuyers Discover?

There are a number of masters and you can apps to possess earliest-date homeowners to remind more folks when deciding to take the latest step from homeownership. Become regarded as a primary-time homebuyer, you need to satisfy any of the following conditions:

- One moms and dad whose past home was jointly had whenever you are married on the former partner.

- People who has got perhaps not had a principal quarters for three years. For many who possessed property in past times and you may hitched your spouse which have not, you can aquire together with her since first-time customers.

- A displaced housewife whose past property is actually possessed as you with their former spouse.

- Somebody who owned a home which was not compliant that have local, county, or model building requirements. The home must be impractical to give on the compliance for all the lower than the expense of creating a different strengthening.

- Someone who previously owned a principal household nonetheless it wasn’t permanently connected to long lasting foundations as required by rules.

Things to consider Before you buy

Before buying the first family, you should know just how homeownership fits in with your brief and you may long-title needs. So what does homeownership suggest for you, and what exactly do you hope to go by getting your family?

Exactly how Is the Financial help?

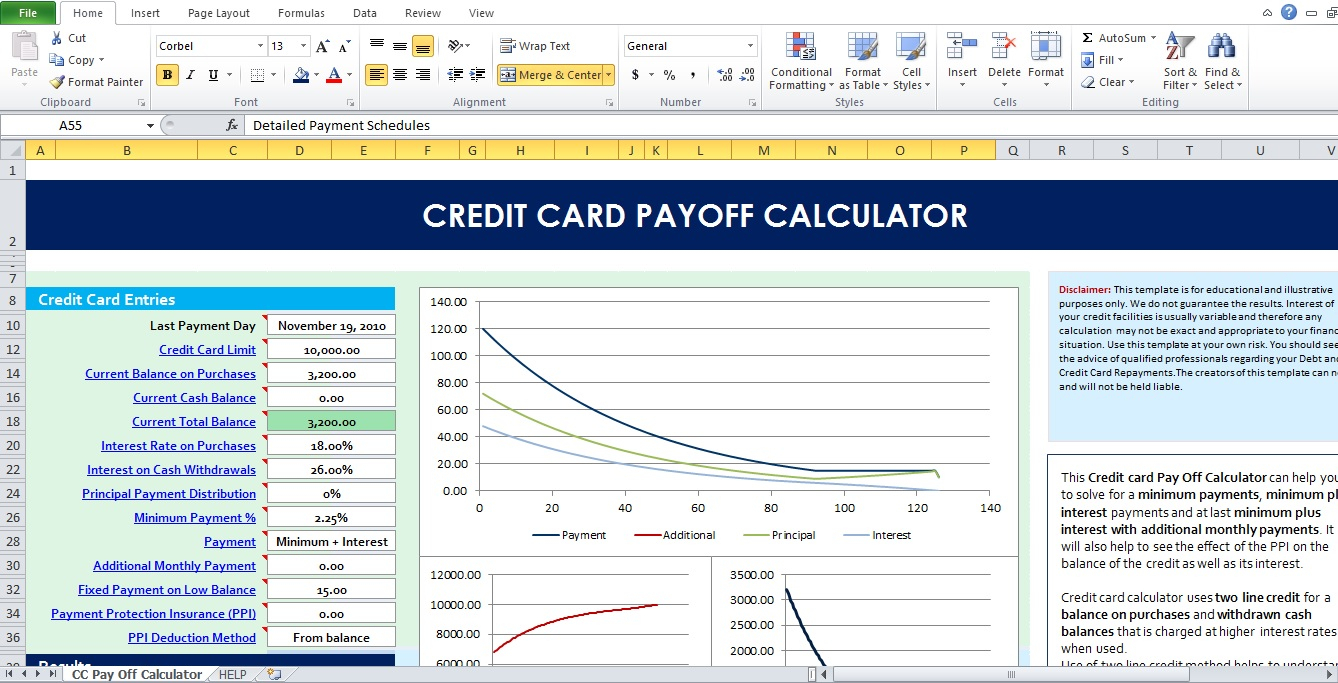

Review your finances even before you start looking during the attributes. You must know if you have the loans on the deposit, may approved to have a mortgage, and also have the cash having furnishing our home and keeping repayments.

Look at the discounts. Ensure you has actually an urgent situation finance which covers half a year to per year regarding living expenses. This should help you always will pay your own home loan in the event that you eradicate your task otherwise endure surprise rates. In addition to, check if you have reserve sufficient with the put, closing costs, and you can one renovations otherwise decorating.

The challenge is keepin constantly your savings liquid enough to supply when you will find your home, but nonetheless gets income that possess rate having rising cost of living. When you yourself have you to three years before you can often pick property, up coming think a beneficial Video game (certificate from put.) These types of keep pace with inflation, however can be punished to have withdrawing the money very early. If you believe it will be below annually until you get your home, after that hold the currency liquids from inside the a premier-desire family savings.

Would a resources and you can song purchasing. Discover in which your finances happens and for which you was in a position to reduce. This will not only help save you more funds, but have an authentic image of the borrowed funds you can afford.