You are able to score a personal bank loan with no money confirmation. Although not, it can be challenging to be eligible for one because most loan providers need a constant money so you’re able to safe a consumer loan. Additionally, may possibly not getting a wise decision to put your monetary wellness on the line if you fail to be able to pay off the mortgage.

The good news is for gig savings workers which have fluctuating money, certain lenders will let you apply for financing no income otherwise allow you to play with low-a career earnings. Prior to you apply for one to, it is critical to seek information and you will think about the pros and you may downsides of going financing instead of a steady money.

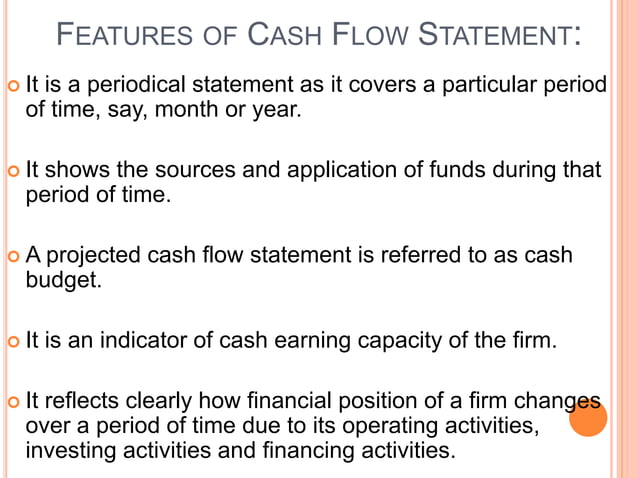

What can You expect When you Make an application for Financing Instead Earnings Examine

The procedure in addition to standards differ whenever applying for good consumer loan for self-functioning without proof of earnings. Rather than confirming your income, the fresh new creditors could possibly get look at the personal credit history.

For the lenders, a good credit score ensures that you’ve got a history of paying financial obligations promptly, causing you to less of a threat getting standard otherwise non-payment of expense. Although this by yourself doesn’t make sure financing approval, an exceptional credit history points your regarding the right recommendations.

By way of example, loan providers generally charge all the way down rates for those who have a beneficial a good credit score number. This enables one to spend less on your debt cost expenses, that should be your aim when obtaining no income verification personal loans.

Other than considering your credit rating, loan providers you’ll ask you to promise or perhaps present research of an asset used as security, like your vehicle or possessions. You should illustrate that you and/or bank normally liquidate so it house on cash to repay your own loans in case there is an effective default. The downside out of pledging equity whenever making an application for personal loans zero money confirmation ‚s the risk of shedding that advantage if you fail to pay-off the loan.

In some instances, lenders should cover on their own by the asking you to appoint a guarantor or co-signer for the loan. It guarantor will be essentially be somebody who can establish a stable income. Just like security, requiring a candidate in order to appoint a good co-signer covers the borrowed funds organization from monetary losses. If you standard, they’re going to go after your co-signer as an alternative.

Particular loan providers also are willing to let people with no money and you can an excellent credit score borrow funds. Yet not, the latest number offered are notably below those accessible to somebody that have steady income and good credit scores. Lenders also can costs extremely large rates so you’re able to offset the risk.

Last but not least, loan providers you certainly will require evidence of solution income apart from your primary concert. They’re Personal Cover benefits if you find yourself retired, returns from your own opportunities, and you will social direction finance, yet others.

Preparing to Sign up for Financing No Money Verification

Having care about-employed somebody, it is only a matter of time before need to seek investment arises. Because you work at your business, you may also soon come upon gaps which make it burdensome for your to repay electric costs, products maintenance, and you will personnel payroll for individuals who get work.

Just be able to find your financial statements manageable before you even need borrow cash. Your economic comments gives prospective loan providers having proof of normal otherwise, about, continual income. Assemble records of funds statements and cash circulate which go right back at the very least 90 days. This is certainly and additionally a way to evaluate in case the organization is actually in good shape or perhaps not.

You might consult a copy of your own credit score and you can rating out-of https://paydayloansconnecticut.com/mechanicsville the around three credit bureaus to own a fee. Make use of the information to work towards enhancing your credit rating. You could begin from the settling one otherwise two of your current finance timely if you possibly could. You could look for errors throughout the profile, so you can fix her or him and increase your credit score.

When it is time for you to make an application for a personal loan without earnings verification, might have worked in the to make your credit score all the way to you can.

Before applying, you will should identify a valuable asset that you could pledge once the guarantee when required. A fundamental choice is the house financial or even the house alone. Although not, you and your partner must’ve made significant payments on the residence’s security before you could borrow secured on the mortgage. Other viable options are the title on your own vehicle, provided this has been fully reduced or is not made use of once the collateral an additional mortgage.

Alternative Resources of Loans To possess Resource without Income Verification

- $five-hundred to $5000 fund

On line lending programs give personal loans so you’re able to gig savings gurus exactly who earn 1099 earnings. You can get immediate access to help you capital for approximately $5000, which can be used to enhance your online business. Bank requirements vary, however should be care about-working and have a work reputation for about 90 days that have monthly income of greater than $3000.

- Friends and family

One way you can buy that loan versus income confirmation is by asking your friends and family for just one. Before you could use the money, make sure you put brand new conditions and terms of your financing. While such transactions might or might not involve a binding agreement, you might err to the side out of caution and you will draw up an official offer to safeguard the fresh welfare out of one another parties. The fresh contract would be to outline the fresh new cost process, plan, and interest rate.

This option sort of investment takes into account your revenue records and charge you only a certain part of the incomes while the payment. That is exactly like a supplier pay day loan it is maybe not restricted to mastercard transactions simply. Loan providers commonly analyze your own financial statements, ount it will allow you to acquire, and you can vehicles-debit your payments from your checking account monthly if you do not fully spend the money for loan.

Summary

You can purchase a consumer loan and no earnings verification, however you may need to contend with highest rates, new pledging away from collateral, and a more stringent processes.

In addition, self-working some body might want to believe alternative types of financing that do not require a fair otherwise a good credit score rating. These are typically family relations money, Atm payday loans, crowdfunding, and many more. These non-antique financing is as convenient in a financial crisis due to the fact bank loans or other traditional sources of resource.