- See Disclosure Records. After acknowledged, you are able to go over their HELOC disclosure agreement with your lender. You’re getting answers to any questions and you can agree with the conditions of one’s loan.

- Get Funded. Immediately after closure happen, your own first draw will be presented within twenty-four instances.

IX. Cost

Home equity credit lines are very different in this they have a blow period followed by an installment months. In the mark several months, you’ll be able to only be necessary to pay desire, but you will need to repay dominant and you may attract in the installment months. Including, let’s say you borrowed $one hundred,100000 using your ten-12 months mark several months and made notice repayments with the equilibrium during the that point. Songs higher, proper? Better, keep in mind that following the 10-12 months mark months, the financing range is no longer accessible, and you might currently have to begin with paying interest and prominent having as much as some other 20 years. As well as, just remember that , payback terms and conditions are very different. It is essential to know the way your HELOC works.

X. Faq’s

Here are methods to commonly-requested questions relating to HELOANs and you can HELOCs. For more information on exactly how home collateral mortgage rates try computed, excite review brand new Key factors part over, or get in touch with financing manager to go over.

Are changing house equity in order to dollars a good idea at this time?

According to your individual things, a great HELOC otherwise a house guarantee mortgage will be a legitimate solution for a while or a severe a lot of time-name exposure with the economic wellness. It’s important to note that these types of options are perhaps not free currency rather than a catch-most of the, effortless solution. It’s great for a back up supply of funds however if out-of a crisis. not, comparable to credit cards, it can also be enticing to blow over your income easily allows. This will initiate an obligations period which is hard to escape. If you’re considering property equity credit line otherwise a great household equity loan, it is of the utmost importance to manage your money inside a way that prospects your off obligations as quickly as you’ll be able to. It’s well worth continual you to a great HELOC otherwise a property guarantee financing comes with the danger of foreclosures for people who standard toward payments. Unlike debt, that is unsecured, a home security credit line spends your home given that collateral. Therefore, for those who end and make your instalments, then you could treat your house. not, if you are comfortable making the repayments, and you’ve got many collateral of your house, and domestic equity mortgage rates of interest are great, it is going to be a fascinating option. Make sure you talk about your options with financing administrator to see if it is a good fit for your requirements.

What’s the mark period towards a beneficial HELOC?

As temporarily stated a lot more than, the brand new draw months is the 1st period of time that a lender allows you to withdraw funds from a beneficial https://paydayloancolorado.net/battlement-mesa/ HELOC. During this time period, you’re going to be permitted to obtain from the credit line upwards into the maximum credit limit and make minimum costs or perhaps interest-just repayments towards the count you have lent. When the at the conclusion of your mark months (generally speaking 5-a decade) the thing is that that you however you prefer entry to money, your own bank get will let you refinance the brand new HELOC. Who in turn, begin a special mark months.

What is the payment several months for the good HELOC?

Immediately following your mark months comes to an end, you will have to start making monthly installments which cover both the dominating and you will attention. Some tips about what is called the latest fees several months, and you will money can move up significantly if you have been and come up with appeal-simply payments until this point. The duration of their HELOC cost months depends on the fresh new conditions of your mortgage. Perhaps one of the most popular issues is actually a thirty-seasons HELOC, that have good ten-year draw several months and you may a 20-year fees months.

Remodel Your home

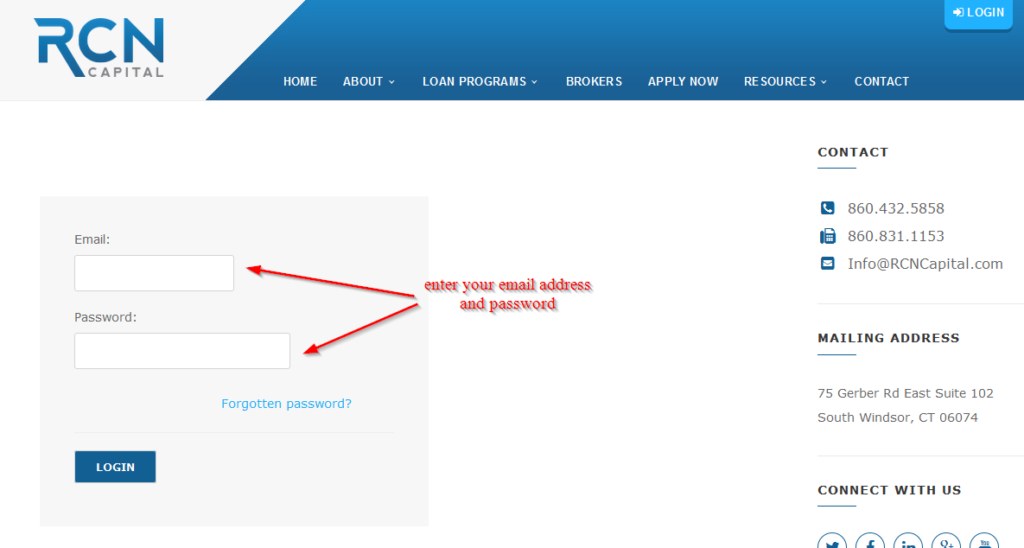

- Pertain. As you prepare to make use of, you might plan a call otherwise set-up an account to begin an application. This type of possibilities which have Strong Real estate loan try buttons above and you can base in the page. It’s a simple techniques, as long as you have your number and you will data in check.