You submitted registered Section thirteen personal bankruptcy to keep your domestic and you will prevent the foreclosure. You’ve safe your residence, for the moment.

Although challenge to help keep your domestic is not over, simply because there’s a-stay. You’ve received from earliest bullet.

You should stay on your toes into the equilibrium out of brand new fits to help you emerge with your domestic secure in the bottom of one’s bankruptcy.

Mortgage brokers rating special idea

Anglo saxon rules, where Us laws is actually removed, provides much time considering sorts of safety toward claims from homeowners. Anyway, it absolutely was people who possessed property exactly who authored the fresh new guidelines.

One to lien entitles the financial institution in order to typical money; if the payments aren’t produced, the financial institution can also be inquire about respite from remain to foreclose.

The newest exception to this rule is when the worth of the fresh new guarantee is faster compared to the overall of one’s liens ahead of the lien inside concern. Think: under water 2nd home loan.

step 1. Regular mortgage repayments expected

Very Section thirteen preparations provide your trustee pays the new arrears on the mortgage, as you make the costs which come due immediately following submitting.

Constantly, homeowners rating fixated to the paying the arrearages on the mortgage you to definitely they neglect, otherwise battle, towards the constant payments.

Court was intolerant out of borrowers who need the security of case of bankruptcy sit, but don’t need definitely its obligations to pay brand new monthly installments which come due after filing.

You to intolerance leaks over toward dismissal away from Part thirteen cases in the place of a release when debtors are not able to build latest repayments.

dos. Look for other liens

Chapter thirteen isn’t really restricted to fixing issues with financial liens. The bundle can either avoid entirely or reduce the quantity of tax or judgment liens,

Make sure that you see the personal list to find out if one avoidable liens has actually affixed, undetected, to your residence.

step three. Follow modification

Your best option is to concur with the lender towards a change in your own financial. Little into the Section thirteen ends the newest functions off provided modification.

Apparently, the fresh new altered mortgage both folds new arrears into the mortgage equilibrium, is repaid over the longevity of the mortgage same day emergency no credit check installment loans. Or, modification designates the main balance while the perhaps not influence appeal, but payable within loan-avoid otherwise sale.

A modification you to treatments the newest arrears can get eliminate the financial arrears portion of a section 13 payment per month, thereby increasing the odds of profits.

cuatro. Opinion the brand new lender’s allege

In order to be paid-in a chapter 13, a collector need to file a proof of claim. Having mortgage loans safeguarded from the debtor’s principal home, a detailed connection required.

The loan connection need to make up costs and you will fees to the mortgage regarding big date of your own very first, uncured default.

Brand new POC also includes an analysis of any escrowed taxes and you may insurance, and the adequacy of your payment to spend the individuals costs.

5. Remain info of costs

The process away from accounting alter with bankruptcy: money generated shortly after filing should feel paid to a great independent accounting for the mortgage, as the pre bankruptcy record really stands by yourself

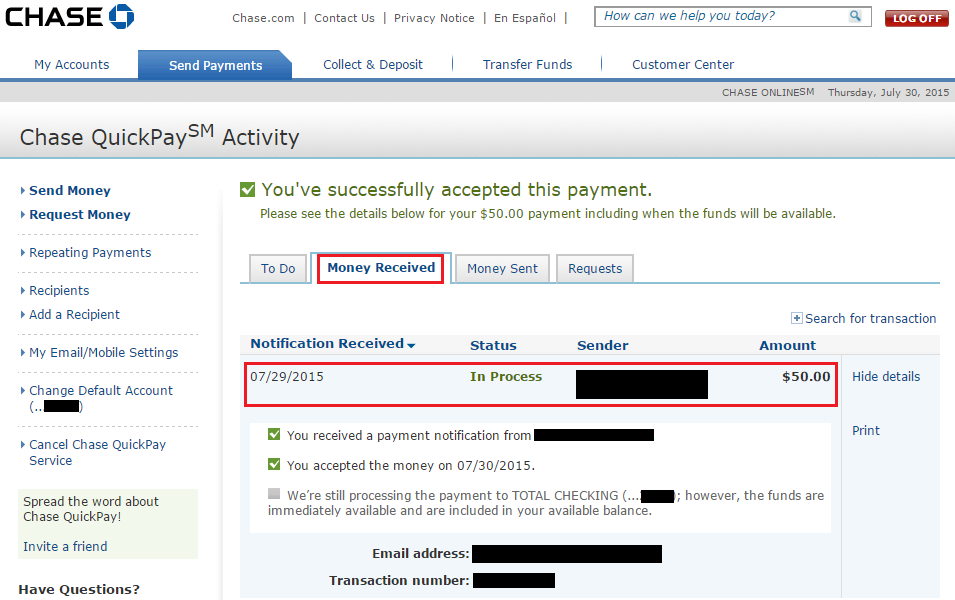

We tell readers to expend which have report inspections to their accounts and posting the fresh new payment of the a strategy that becomes you an excellent acknowledgment abreast of birth into the servicer.

Its a publicity, I understand, nevertheless get accurate documentation from your own financial one to the latest glance at try cashed, and you have proof it was lead. The added debts is absolutely nothing towards price of the attorneys needing to find the details indicating your reduced.

When your monthly mortgage payment changes after you document case of bankruptcy, the new servicer need certainly to send you a notification Of Payment Change.

The alteration can be determined by the mortgage loan transform otherwise a change in the expense of escrowed fees otherwise insurance policies.

Whilst it comes on a legal function, and you can looks heavy, you’ve got to see clearly and you can to evolve the post processing payments on your own home loan appropriately. For people who dispute the alteration, you can query the newest legal getting a listening.

seven. Mine instance-end rules

When you’ve produced your last commission with the trustee, bankruptcy laws need an alerts on the financial servicer in regards to the county of your mortgage equilibrium.

If your financial states one sometimes this new pre-bankruptcy allege wasn’t paid in full, Otherwise, that we now have outstanding amounts occurring after you submitted, they have to document an answer.

So it label-and-response techniques flushes aside people problems that show about lender’s guides, and provides a process and you will a court to help you types something out.

For folks who change your head

Some thing change over big date. If you discover that keeping our home no further matches which have your financial coming, tell your lawyer instantly.

The confirmed Part thirteen plan obligates you to improve money you promised and additionally obligating creditors to stand down.

Far too many debtors has just get right to the avoid of one’s case as well as have their times ignored, rather than a release, as they eliminated using towards financial and you will failed to aware its attorneys.