In this post

- What exactly is Your own A job Problem While looking for Moving Fund?

- Swinging Loans – Staying with an equivalent Company

- Ought i Rating a mortgage easily Has a different sort of Work?

- Additional Contingencies to have home financing Relocation Financing

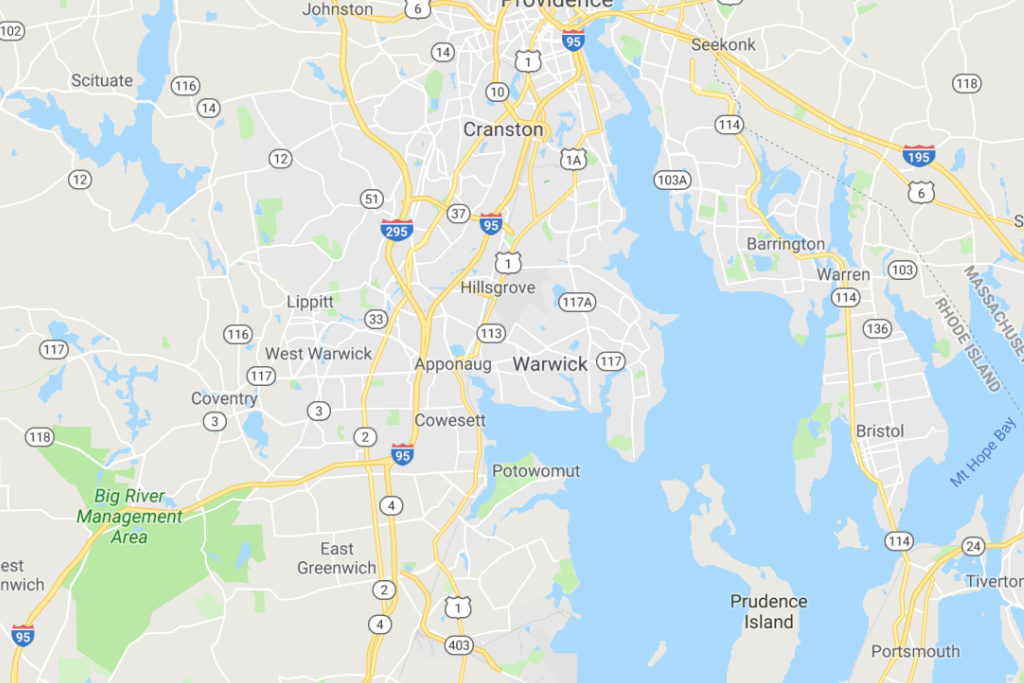

Moving Money Moving to an alternate county (if you don’t another city within your present state) gifts plenty of demands. You may realise daunting to start with, however your disperse can go most smoothly if you are planning securely as well as have every proper bits in position. Regardless if you are switching work, moving to possess loved ones purposes, or relocating the level of most other grounds, you will have to navigate the purchase of a special family inside the your brand-new town. This is how a moving home loan may help.

What exactly is Your own A career Problem When shopping for Swinging Money?

People financial giving a mortgage loan might possibly be mostly concerned about your capability to pay off the borrowed funds. Thus, your a job state was one of the primary some thing it remark together with your credit score and other monetary items. We recommend that you have made pre-recognized for the mortgage before their relocation, especially if you know already where exactly you are supposed.

When you yourself have a job already in line, that’s a significant advantage as the loan providers usually component that to your your own pre-approval opinion. Without having a separate business yet ,, this may be becomes harder. Don’t worry, yet not. You can nonetheless rating a relocation financial though your work situation isn’t completely laid out but really. The lender have a tendency to contact your existing employer and you may people possible employers where you tends to be applying. They make inquiries regarding your occupations, your toughness, your income status and settlement build. These types of concerns was intended for choosing when you’re a reduced-risk moving mortgage applicant otherwise a top-risk candidate for a mortgage loan.

If you have been at the latest work at under 2 yrs or are currently underemployed, the lending company will generally inquire observe the full employment record. It is best to own you to definitely pointers waiting, it are going to be shared upon demand.

Swinging Finance Sticking with a comparable Employer

Of numerous specialists transferring nowadays are recognizing performs-from-household ranking. They aren’t fundamentally linked with the area in which its manager try found. They may like to get out out-of condition or to an excellent less costly rural urban area in identical state. Following, you will find people staff that moving in into the exact same team, often trying out a unique reputation/campaign or perhaps mobile workplace towns. In these instances, being qualified having a moving loan on brand new town is commonly quite easy. Your a position and you will money is actually good and you also present way less out-of a lending exposure than just anybody whose problem are quicker clear.

You need to talk to your employer regarding the relocation bundles. They truly are prepared to assist shelter certain or every one of the moving costs. They could along with actually render their financial moving program or protected home loan buyouts. Of several high organizations spouse that have lenders provide their finest group help with swinging financing while in the corporate relocations.

Ought i Score an interest rate easily Possess another Job?

For those who have a separate jobs inside an alternative globe or you are nevertheless trying to find employment on your this new town, expect you’ll show off your a position history. Repeated community motions are a warning sign that the money actually constant and also you establish payday loans Basalt a lot more of a danger towards financial. Most other common concerns are offered gaps on the a career records. Any jobless episodes longer than 6 months tend to hinder your chances from being qualified having a moving real estate loan in case the the brand new work is not secured in yet ,. There are several exceptions compared to that laws, although. Armed forces service professionals returning out of deployment and complete-day students transitioning into team might be addressed with a whole lot more forgiveness than enough time-day gurus having sketchy a career records.

To sum up, your chances of taking a mortgage loan throughout the a relocation commonly depend largely on your employment problem. People with strong employment info and you will a services already in line must have nothing wrong qualifying to own home financing within brand new urban area. People that expose so much more chance may need to undergo much more red tape to help you qualify.

Extra Contingencies having a home loan Moving Mortgage

Other variables that can come into play was if you find yourself selling your existing family and when the fresh marketing might be complete. When it is currently marketed and you’ve got an effective guarantee to put into the your new domestic, it does leave you a bonus. If you find yourself waiting to sell once you move otherwise was swinging even though it is however in the industry or in the closing techniques, you are going to need to exercise a take on significantly more contingencies. The greater amount of cutting-edge this new arrangement, the greater strict people lender will be into the providing home loan pre-approval otherwise final approval.

If you’re moving in, get in touch with Moreira Team now for more information from the relocation mortgages and also to get started with the loan pre-approval.